India: Tata Steel Invites Bid for 15,000 MT Imported Steel Scrap

Out of the total issued quantity, 9,000 MT of HMS and 6,000 MT of Shredded scrap to be quoted on CIF Vizag port (India east coast) and will be sourced through e-auction.

According to the RFQ, scrap packaging should be done in sealed 20ft containers and the origin could be Australia/New Zealand/UK/ Europe/US/North America/South Africa/Malaysia/Singapore/Middle East.

A couple of days back the company official reported that in the last tender floated for total 20,000 MT by the company, only 12,000 MT of scrap was purchased at an average price of Shredded at USD 355/MT and HMS 1 at USD 345/MT on CFR Vizag port basis while around USD 3-4 can be considered as an additional cost of interest on 90 days LC to suppliers cost.

About Tata Steel BSL - In 2018, Tata Steel acquired the Tata Steel BSL Limited (formerly Bhushan Steel Limited) through its wholly-owned subsidiary with a steel production capacity of 5.6 MnTPA located in Odisha.

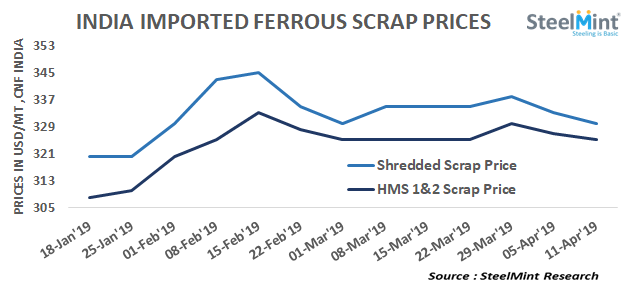

Global scrap prices move down USD 15-20/MT in last 2 weeks’ time - Turkey, the largest importer of scrap which drives global imported scrap prices has observed successive fall on limited trades being reported since the last two weeks. In the recent US deal concluded, Marmara based steelmaker booked a 30,000 MT cargo comprising HMS 1&2 (80:20) at USD 306/MT, Shredded USD 311/MT and Bonus scrap at USD 316/MT, CFR Turkey.

According to SteelMint’s price assessment, US origin HMS (80:20) scrap moved down to USD 306-307/MT, CFR Turkey. While HMS 1&2 (80:20) of Europe origin stands at around USD 303-305/MT, CFR.

India observes imported scrap trades in containers - Indian imported scrap activities remain slow amid upcoming elections and less clarity on global prices. In recent trades reported for containerized scrap by leading buyers based on Western coast, Shredded booked from UK, Europe and US stands at around USD 330/MT, CFR Nhava Sheva, South African HMS 1&2 at around USD 335-338/MT,CFR from South Africa and HMS 1 from Dubai at around USD 325-330/MT, CFR depending on quality.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Barrick’s Reko Diq in line for $410M ADB backing

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts