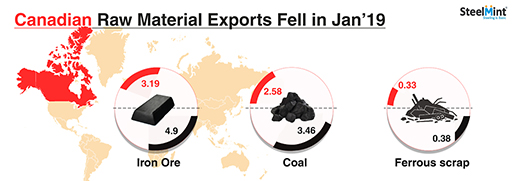

Canadian Raw Material Exports Fell in Jan'19

On yearly premises, exports increased 28% compared to 2.49 MnT in Jan'18. Perhaps China continue to prefer low-grade iron ore resulted dropped in export from Canada.

China continued to be largest importer of Canadian iron ore at 0.52 MnT for Jan'19, down 66% as against 1.53 MnT in Dec'18. Netherland stood second largest importer at 0.43 MnT (up more than two folds) followed by France at 0.38 MnT (down 17%).

Canadian ferrous scrap exports dropped 15% M-o-M in Jan'19

According to data released by customs department, Canada exported 328,207 MT ferrous scrap in Jan'19 against 383,830 MT scrap exports recorded in Dec'18. Canadian crude steel output remained flat at 1.15 MnT in Jan'19 on monthly premises which could have supported domestic scrap consumption, while increased domestic scrap demand in US amid changing trade dynamics might have resulted in a drop in scrap imports from Canada in Jan'19.

On yearly premises, scrap exports declined marginally by 6% Y-o-Y that of 347,607 MT ferrous scrap in Jan'18.

United States remained the largest importer of Canadian ferrous scrap occupying highest 75% share in Jan'19. US imported 246,976 MT ferrous scrap, down 16% M-o-M followed by other major importers like Egypt (52,500 MT, up 5%), India (9,471 MT, up 10%) and Taiwan (5,680 MT, down 28%).

Canadian coal exports down 25% M-o-M

Canadian coal exports had fell 25% M-o-M to 2.58 MnT in Jan'19, on the back of lower coal purchasing from its major customers-South Korea, Japan and China. But, exports were 18% higher on the year from 2.19 MnT in Jan'19.

High prices have driven a renewed interest in Canada's coking coal projects, which are expected to be back online, and contribute to the country's export volume.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

UBS lifts 2026 gold forecasts on US macro risks

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

EverMetal launches US-based critical metals recycling platform

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

Afghanistan says China seeks its participation in Belt and Road Initiative

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Pan American locks in $2.1B takeover of MAG Silver

Iron ore prices hit one-week high after fatal incident halts Rio Tinto’s Simandou project

US adds copper, potash, silicon in critical minerals list shake-up

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Pan American locks in $2.1B takeover of MAG Silver

Iron ore prices hit one-week high after fatal incident halts Rio Tinto’s Simandou project

US adds copper, potash, silicon in critical minerals list shake-up

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery