Indian Iron Ore Exports May Hit 5 MnT in Q1 FY20

The January collapse of mine dam waste in Brazil operational at Vale followed by recent cyclone in Australia is expected to disrupt supply of high grade seaborne iron ore by about 75-80 MnT in 2019. These incidents have led iron ore prices to hit 5 years high at USD 95.05/t CFR China for 62% iron ore fines. Market participants highlight that market is reacting on lack of prompt shipments for April from Australia.

Sharp rise in high grade iron ore prices have led Chinese mills to hunt for low grade iron ore, when steel prices have not increased in the same proportion. Fe 58/57% iron ore fines prices have increased by USD 5-10/MT in last 2 months to USD 60/MT, CFR China or equivalent to USD 50/MT FOB India.

High demand for low grade ore from China has turned Indian iron ore exporters active. Many merchant traders and big miners like Rungta and Essel have increased their shipments to east coast. Also, traders like SM Niryat, Bagadiya Brothers, Kashvi Power are booking decent quantities.

It is to be noted that low grade ore (below 58% Fe) does not attract any export duty where as above 58% Fe iron ore have an export duty of 30% from India.

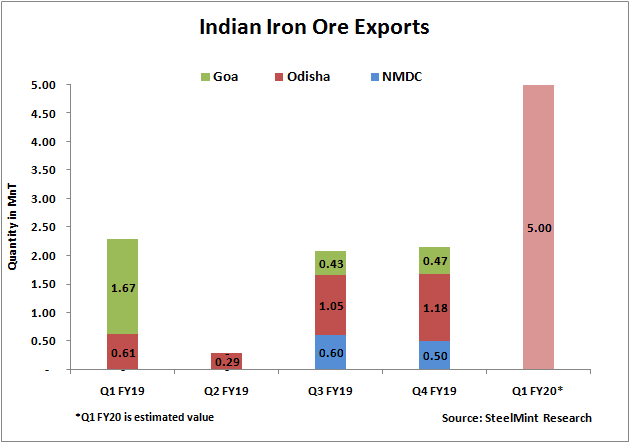

According to iron ore export data maintained by SteelMint, India exported about 2.15 MnT in Q4 FY19 and 2.28 MnT in Q1 FY19.

Looking at iron ore movement domestically, we expect iron ore exports to touch 5 MnT in Q1 FY20.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook