Indian Pellet Exports Remain Stable in FY'19

Indian pellet exports observed improved demand from Chinese steel mills during Sept-Nov 2018, due to strict governmental regulations in China and announcement of capacity cuts. Later amid shrinking steel margins and less stringent regulations, Chinese mills preferred low-grade iron ore and concentrate resulting in limited inquiries for pellets. Indian pellet makers turned active in non-Chinese markets too.

Indian pellet export reference price assessment increased by 14% to USD 111/MT, FoB India in FY'19 against USD 97/MT, FoB in FY'18.

However, on monthly basis, Indian pellet exports have increased sharply by 44% to 1.17 MnT in Mar'19 as against 0.81 MnT in Feb'19.

Indian pellet export volumes to non-Chinese markets increased in FY19

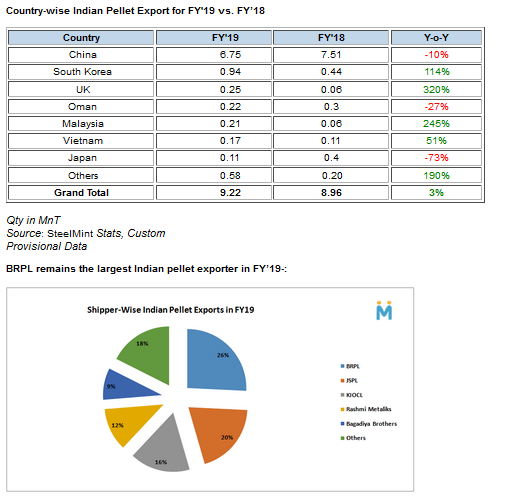

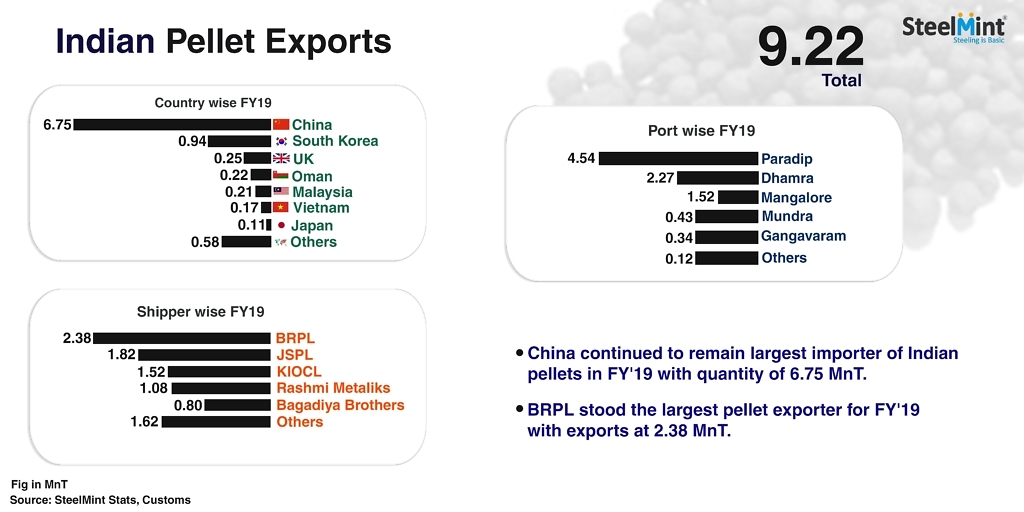

China continued to remain the largest importer of Indian pellets in FY'19 with the quantity of 6.75 MnT, down by 10% as against 7.39 MnT in FY'18. South Korea stood the 2nd largest importer of Indian pellet and increased two-fold for the financial year FY’19 at 0.94 MnT. Other destinations for Indian pellet exports were the UK (United Kingdom) at 0.25 MnT and Oman at 0.22 MnT.

In the financial year, FY’19 India pellet exporter looked for non-Chinese markets and increased its exports by 57% to 2.47 MnT as against previous fiscal year at 1.57 MnT.

BRPL stood the largest pellet exporter in FY'19 with exports at 2.38 MnT, increased significantly by 40% as against 1.70 MnT in FY’18.

JSPL stood second largest in the list of Indian pellet exports at 1.82 MnT (down 5% Y-o-Y), followed by KIOCL at 1.52 MnT (down 4%) and Rashmi Metaliks 1.08 MnT in FY’19. Jindal SAW pellet exports moved up sharply by 49% in FY'19 to 0.32 MnT as against 0.22 MnT in FY'18. It majorly supplied to POSCO, South Korea.

Other exporters were Essar Steel, Arya Iron & Steel, and others.

Paradeep port accounted almost 50% share in FY'19 Indian pellet exports

Pellet exports from Paradeep port recorded highest in FY'19 at 4.54 MnT against 4.63 MnT in FY'18 up by 2%, followed by Dhamra port at 2.27 MnT (up 14%), Mangalore port at 1.52 MnT (down 4%) and Mundra port at 0.43 MnT.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Fortuna rises on improved resource estimate for Senegal gold project

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse