Bangladesh Steel Mills Book Two Bulk Scrap Cargoes - Sources

According to sources, amid witnessing a series of bulk scrap trades towards closing last week by Turkish steel mills, Bangladesh steel mills also booked two bulk cargoes each from leading scrap suppliers based in US west coast comprising Shredded scrap at around USD 360-365/MT, CFR Chittagong levels.

According to sources, one of the bulk cargo is comprising of 32,000 MT Shredded scrap while both cargoes are expected for May month delivery. Sources pointed out that US bulk scrap prices are higher as compared to UK/Europe prices at the moment mainly on strong domestic demand in US and poor weather conditions. However, domestic steel sentiments in Bangladesh remained almost similar since past few weeks’ time.

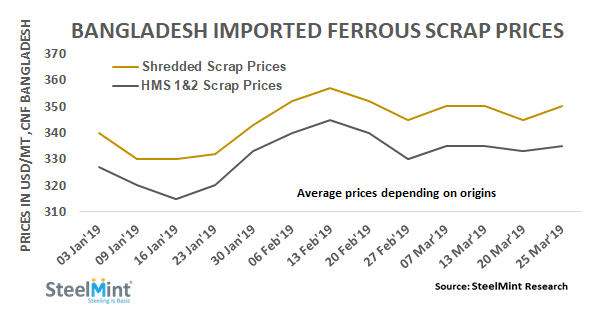

SteelMint’s price assessment for containerized Shredded scrap stands at around USD 350/MT, CFR Chittagong up marginally by USD 5/MT against the last week’s report. Scrap yards based in Europe and UK are quoting USD 350-355/MT, CFR levels as supply remain tight in the global market.

Containerized P&S scrap from Canada and Brazil traded at around USD 360-365/MT, CFR Chittagong while containerized HMS 1 from Chile and Brazil assessed at around USD 335-340/MT, CFR. Shipyard scrap selling prices increased by around BDT 1000/MT to BDT 38,000/MT (USD 452) ex-Chittagong against the last report.

Bangladesh bulk scrap imports recorded at 29,550 MT in Feb’19 observing a sharp drop of 88% M-o-M against a record high of 236,783 MT in Jan’19.

According to data maintained with SteelMint, Bangladesh imported 1,077,024 MT bulk ferrous scrap during CY18, marginally up as against 1,037,094 MT in 2017. Top ferrous scrap exporters were USA, UK, Japan and Russia. Around 35-40% share of total scrap imports is occupied by bulk cargoes in Bangladesh.

Key updates-

-- According to SteelMint’s price assessment, US origin HMS (80:20) scrap stands at USD 325/MT, CFR Turkey. While HMS 1&2 (80:20) of Europe origin stands at around USD 318-320/MT, CFR.

-- According to SteelDaily’s report, South Korean leading steelmaker Dongkuk steel has booked a bulk scrap cargo of HMS 1 from the US at USD 350/MT, CFR South Korea.

-- Indian scrap importers observed improved sentiments for imported scrap recently and heard to have booked containerized HMS 1 in the range USD 325-330/MT, CFR Nhava Sheva from Dubai and South Africa.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook