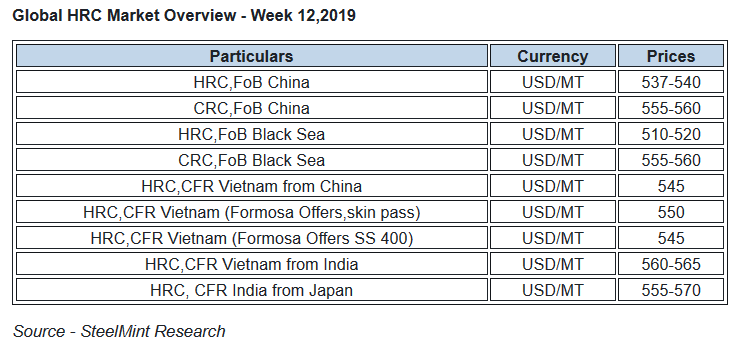

Global HRC Market Overview - Week 12, 2019

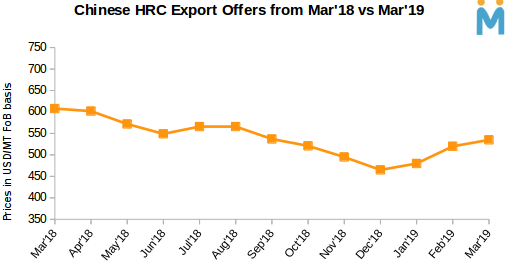

Robust buying in domestic market after reduction in VAT rates from 16% to 13% led to surge in steel prices from China.

Currently nation’s HRC export offers are assessed at around USD 537-540/MT FoB basis.However in the beginning of the week HRC export offers stood around USD 535-540/MT FoB China.

Domestic prices in eastern China (Shanghai) moved up by RMB 60-70/MT D-o-D basis and stood at RMB 3,860-3,870/MT.

Meanwhile prices at Northern China up by RMB 60/MT and stood at RMB 3,810-3,830/MT D-o-D basis in Northern China (Tangshan).

CIS-origin HRC export offers move up this week - This week CIS nation’s HRC export offers moved up over low availability.

Currently offers are in the range USD 510-520/MT FoB Black Sea. Last week CIS nation's HRC export offers stood at USD 500-520/MT FoB basis.

Indian mills hold HRC export offers firm- Indian steel mill booked HRC to Malaysia for April shipments. SteelMint learned from market sources that major Indian steelmaker concluded a deal of 10,000 MT of HRC with Malaysia at USD 560/MT CFR basis for April shipments.

Meanwhile Indian steel mills have resumed offers for export to SE Asian markets. Offers from major Indian mills are heard at around USD 560-565/MT CFR Vietnam for April shipments. No fresh offers to Nepal market were heard this week.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook