Chinese Steel Market Highlights - Week 10, 2019

China has cut its value-added tax rate from 16% to 13% for most industries and from 10% to 9% for the transport and construction sectors. This will help Chinese steel industry to increase their profit margins and will provide more flexibility in setting prices. Meanwhile tax reduction will also aid to control operational cost and increase efficiency.

--Meanwhile Tangshan has extended a level 1 smog alert the highest in China’s four-tier pollution warning system for indefinite period and requires steel mills to curb output by 40% to 70% or even stop production,depending on the scale of their emissions.

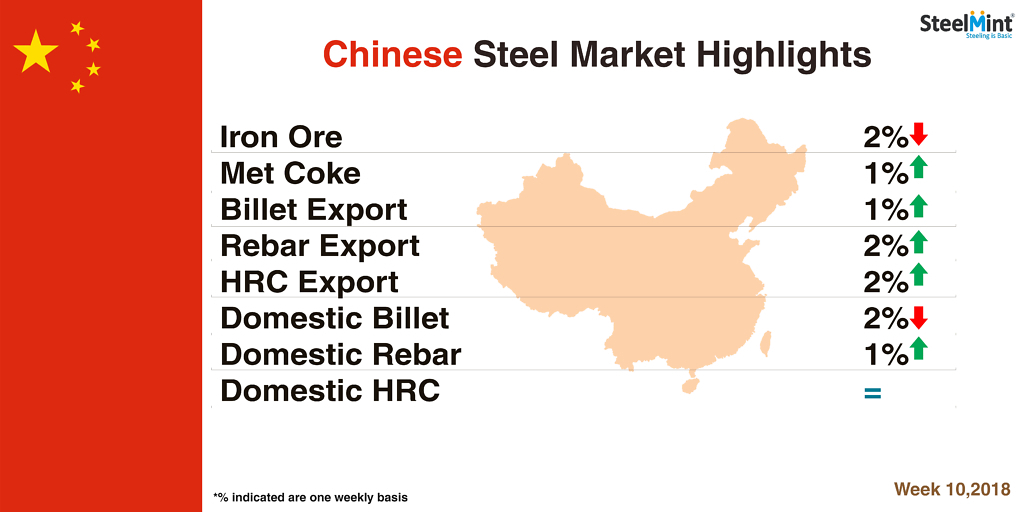

-- China iron ore imports hit 10-month low at 83.08 MnT in Feb'19 down by 9% M-o-M Finished steel exports reported a decline of 27% on monthly basis to 4.512 MnT in Feb’19 in contrast to 6.188 MnT in Jan’19 over holidays.

Chinese spot iron ore prices drop towards the weekend- Chinese spot iron ore prices opened up this week at USD 86.80/MT, CFR China and dropped to USD 84.85/MT towards the weekend. The prices fell due to lowered inquiries by Chinese mills owing to sufficient material availability. Iron ore inventory at major Chinese ports have increased to 147.65 MnT this week as against 146.05 MnT a week ago.

Spot lump premium witnessed rise to USD 0.36/DMTU for the week as against USD 0.3350 /DMTU a week ago. The lump premium is supported due to strong sintering controls in March. Also, China’s largest steelmaking city of Tangshan has extended the sintering cuts from an earlier deadline of 6th March to curb emission.

Spot pellet premium down by USD 6.65/MT this week-: Spot pellet premium for Fe 65% grade pellets assessed at USD 35.45 /DMT, CFR China this week, down against USD 42.10/DMT a week before.

The premiums have dropped amidst Chinese mills preference for low grade ore and sufficient material availability at Chinese ports.

Chinese pellet port stock inventory increased to 4.9 MnT this week compared to 4.6 MnT towards last weekend.

Coking coal offers inch up this week - Seaborne premium-grade coking coal prices inch up this week amid resumption of trade activities from Chinese buyers.

Thus, premium HCC coking coal prices are heard around USD 214.25/MT FoB Australia. However last week the offers was around USD 211.7/MT FoB Australia.

Chinese domestic billet prices fell towards week end- Domestic billet prices in China’s Tangshan for 150*150mm closed this week at RMB 3,520/MT (ex-works, including VAT) down by around RMB 50/MT W-o-W. Although no billet export offers were heard last week but price would be assessed around USD 485-490/MT, FoB.

Chinese HRC export offers rise further- Chinese HRC export offers continued to show uptrend amid improved buying and recovery in demand prevailing among end users in China.Buyers are actively booking the material for April shipments.

Thus Chinese HRC export offers moved up by USD 15-20/MT on weekly basis.Currently nation’s HRC export offers are assessed at around USD 535-540/MT FoB basis.Last week the offers were in range of USD 520-525/MT FoB basis.

Domestic prices in eastern China (Shanghai) moved up by RMB 10/MT on weekly basis and stood at RMB 3,820-3,840/MT as compared to prices at RMB 3,810-3,840/MT in last week.

Chinese re-bar export offers uptick this week- Nation’s re-bar export offers moved up this week over bullish market sentiments as the end users resume buying activities in export market.

Currently,nation’s rebar export offers are at USD 520-530/MT FoB China.Last week the offers was in the range of USD 515-520/MT FoB basis.

Meanwhile domestic rebar prices moved up by RMB 40/MT W-o-W basis and is assessed at RMB 3,780-3,810/MT in (Eastern China). Last week the prices stood at RMB 3,740-3,790/MT.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook