India: Domestic Sponge Iron Offers Correct Amid Slow Down in Inquiries

Industry experts believed that, prices less likely to find support as selling pressure is increasing with the producers amid seasonal better production output.

In addition expected fall in raw material offers, has turned buyers cautious and put them on wait & watch mode for decent procurement, they added.

SteelMint learned that export deals were not up to the mark on higher price quotations, although Bangladeshi buyers seemed interested to buy on lower price range at around USD 330/MT CNF Chittagong.

The participants in eastern India who are actively involved in exports of sponge iron stated, prices should sustain at current levels looking at balanced demand, as domestic demand has softened, while export bookings is gradually picking up.

Meanwhile in central India - Raipur, the integrated plants reported, the suppliers are quite active in current circumstances as almost all kilns are running at high capacities. Amid low demand, suppliers might hurriedly conclude deals at bids . Hence prices significant fall in last 2 days by INR 500/MT.

Coming to southern India - Bellary where the large number of standalone sponge producers are based, mentioned that demand from outside state (Western India) is seen at lowered offers. As per them in comparison with price quotation, buyers in Maharashtra are willing to book material at lessen price at close to INR 300-400/MT. Thus this is forcing suppliers to lower offers, who are unable to hold inventory for the time period.

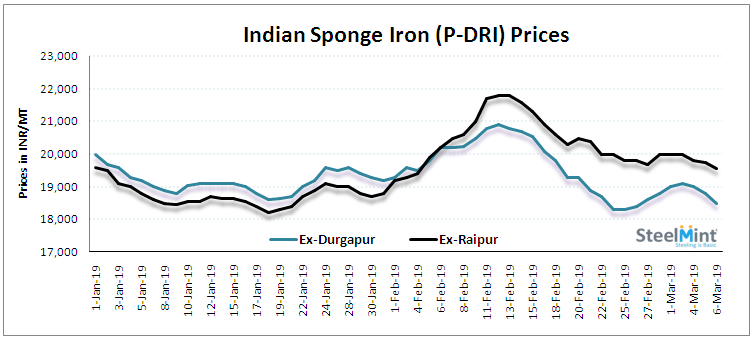

The current offers for Pellet sponge ( P-DRI) is about INR 19,500-19,600/MT ex-Raipur, INR 18,400-18,600/MT ex-Durgapur and INR 20,200-20,300/MT ex- Bellary for 78-80 FeM grade.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Chile’s 2025 vote puts mining sector’s future on the line

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming