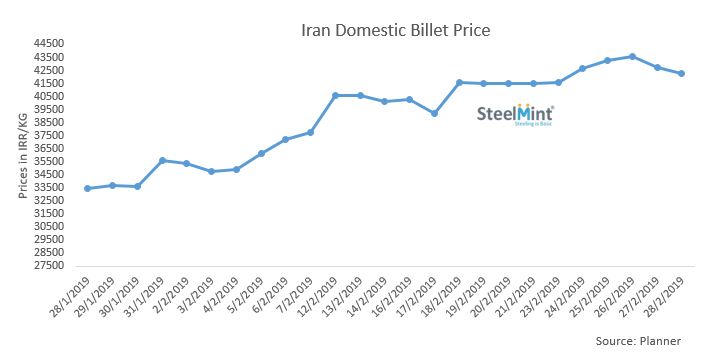

Iran: Domestic Billet Offer Rises Over Limited Supply

According to SteelMint assessment, during the beginning of week 09 (16-21 Feb’19) domestic billet offers were noted to be around IRR 41,550/KG (USD 476/MT). Offers went down on the next day to IRR 42,650 /KG (USD 488/MT). During mid of last week domestic offers of billet rose to IRR 43,600/KG (USD 499/MT). Towards the end of last week offers went down to IRR 42,300/KG (USD 484/MT).

As per Planner, “Currently the market is high but it is expected that prices would go down since Iran is reaching the end of financial year.”

IR Steel quoted, “Billet price hit its peak last week, and price increase was predicted from a week ago, due to limited supply and heavy demand from re-rollers.

Khuzestan steel co sold its product at the highest price of USD 461 /MT ex-work including 9% VAT on Tuesday, while it had sold it at USD 441/MT in the previous offer. After this transaction market slowed down. Billet supply improved and re-rollers stayed back.

This condition was expected. On the other hand, downward trend of global billet price, transportation problem for Iranian products and New Iranian Year Holidays that will actually start from next week onward, will help billet price reverse.

Some market participants may start forward purchasing rebar in hope of higher prices next Iranian Year ( from 21 March onward), but first half of spring is usually recession time in Iran market, with quiet sentiment of Holy Month of Ramadan which will be added to it next year.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook