India: Rebar Demand in Secondary Market Awaits Clarity

As per SteelMint assessment, thin trade volume and low buying inquiries can raise selling pressure and this may result slight price corrections in near term as offers have narrowed down today by INR 100-200/MT on D-o-D basis.

However in Central and Western regions - industrialists shared that, inventories are on average levels owing to considerable trade volume in last week and might not impact significantly. However if lack of response continues then prices might come down, they added.

Further, Central region Chhattisgarh (Raipur) based re-rollers association has increased rebar guage parity by INR 300/MT to INR 2,500/MT (12-25 mm) w.e.f. 05th Mar'19 and basic size considered with 28 mm.

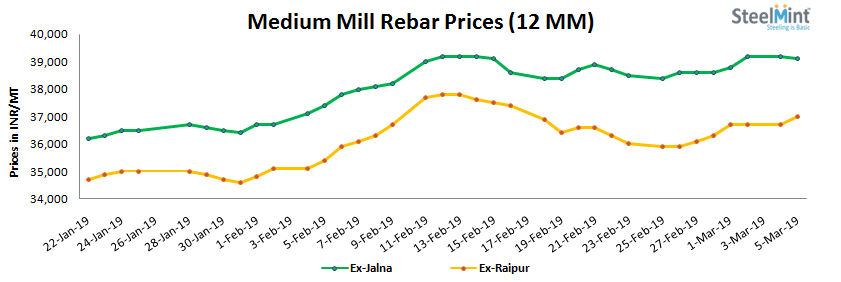

On weekly basis, prices surged up to INR 1,500/MT particularly in East region and in rest of the locations by around INR 500-1,000/MT.

Trade Updates ( Rebar 12 mm)

-- Central region, Raipur based - SPEED TMT unchanged their current offering INR 37,200/MT.

-- Gujarat based, Mono Steel (India) Ltd. (Mono TMT) current offering INR 39,800/MT FoR.

-- Gujarat based Shreeyam Power & Steel Industries Ltd branding as National TMT current offering at INR 39,800/MT FoR (Down by INR 200/MT).

-- Jalna based Rajuri Steel Pvt Ltd (Rajuri TMT) current offering at INR 39,100/MT (Down by INR 300/MT).

-- Mumbai based Vistar Metal Ind. Pvt. Ltd. (Vistar TMT) unchanged their offering at INR 39,100/MT.

-- Chennai based ARS Steel (ARS 500 D) current offering around at INR 41,600/MT.

-- South region based Prakash Ferrous Industries Pvt. Ltd (Tirumala) current offering at INR 40,500/MT.

Note – Prices mentioned above are ex-work, excluding GST & changes are day basis.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook