Will Graphite Electrode Prices Revive in coming days of 2019?

The Chinese government’s decision to shut down old polluting steel capacities, mainly blast furnaces, resulted in a 31% drop in steel exports from the country in 2017. This forced other countries to increase their production capacities, which was mainly done via the EAF route. This resulted in a huge demand for graphite electrodes as approximately 2–2.5 kg of a graphite electrode is used in the production of one tonne of steel.

However, after hitting new highs last year, the Chinese electrodes prices started rallying towards the end of 2018 with the start of the winter heating season. According to the data with SteelMint, the GE prices in China have plunged down by an average of 50 to 55% in time span of just four months starting from Nov’18 till Feb’19.

Subsequently, this has raised a big question in the minds of market participants that, is this price decline a change caused by real demand-supply mismatch or it is just a phase of short-term volatility and will this downtrend in Chinese GE prices continue in the long run? Let us analyze a few of the important factors that will help us answer the above queries.

China will continue to come up with EAF capacities

Despite the plunge in the last four months, the GE prices continue to remain elevated even today against the price levels of 2016 and 2017. As per our analysis, going forward the prices are expected to remain buoyant mainly on account of new EAF capacities coming up in China. EAF steel’s share is expected to increase to 20% by 2020, compared with 6% in 2016 and 9% in 2017 and 12% in 2018. This could increase the EAF steel output to 120 MnT by 2020, compared with 52 MnT in 2016, thereby creating an additional demand of 240,000–300,000 tonnes of graphite electrodes.

China’s strict replacement policy in the steel sector

China’s decision to keep a lid on steel capacity in the country by way of the 1.25:1 steel replacement policy will force other countries to increase its steel production. This is because as per the policy, for every 1 MnT of new steel capacity in China, 1.25 MnT of old polluting capacity needs to be closed in the country. This should drive higher steel production in other countries and in turn boost demand for graphite electrodes as additional steel production is likely to come through EAF route.

Slow pace of new electrodes capacity release

From the latter half of 2017, the domestic GE demand in China has increased significantly resulting which the profits of GE manufactures have also added up motivating them to expand existing or add up new capacities. As per the country’s forecasts, China is likely to add about 2.12 MnT of GE capacities by 2020.

However, if we look at the past track records, the capacity additions in the last year of 2018 have been not as expected. According to IC Carbon statistics, 19 companies have planned to produce 821,000 tonne of graphite electrodes, but as of November 2018, only five graphite electrode companies have completed the construction of their plants and are put into production which means that GE demand in China is still higher than its supply.

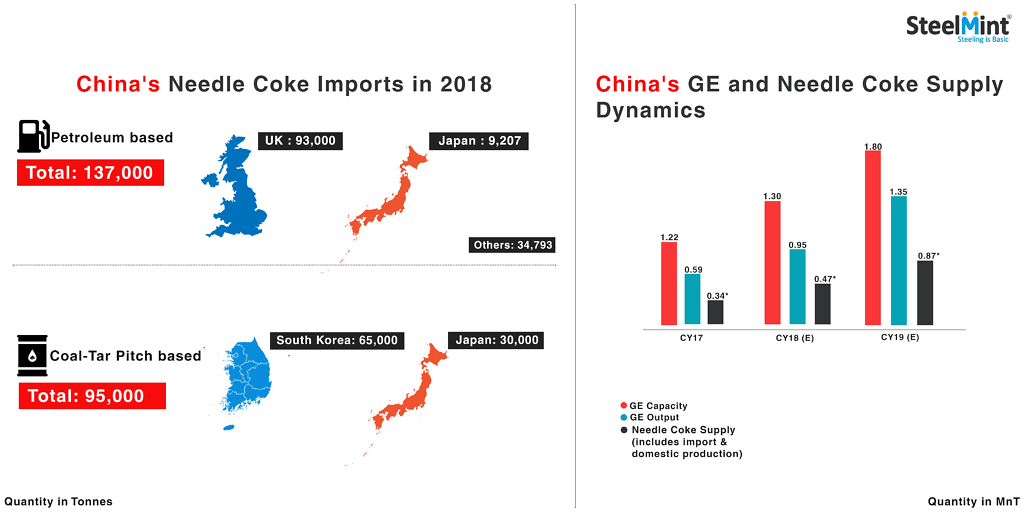

Lack of good quality needle coke supplies

The supply of good-quality needle coke which is a key raw material for the production of high-grade electrodes is quite limited in China resulting in its tight supply and high prices. The domestic needle coke prices have remained stable at RMB 2.8-3.4 million per tonne over the past few weeks. However, as far as needle coke supply in the ongoing year is concerned, it is expected that in the first half of 2019, the tight supply situation of the needle coke market will not change. This is because although the country has plans to add more needle coke capacity, the majority of these plants are for pitch coke and face significant challenges of sourcing high-quality coal tar pitch and producing at consistent quality levels.

Also, according to the industry estimates, China’s needle coke supplies in 2019 including both production and imports is estimated to be around 870,000 tonnes whereas its demand including both from GE and lithium battery segment is expected to be around 940,000 tonnes. This means that China needle coke supply will see a shortfall of 89,000 tonnes in 2019 which will ultimately affect the graphite electrodes output and support its prices.

Conclusion

Thus, analyzing the above situation in China’s GE market, it can be concluded that the recent fall in GE prices in China is majorly due to drop in country’s steel prices and tepid domestic steel demand during winters. However, this trend will not continue for long given the stricter output curbs announced by China’s Tangshan and Xuzhou cities this week, China’s promotion to EAFs for steel production, slow growth in GE capacities, lesser electrodes inventory, and uptrend in UHP grade GE prices of other countries like Japan and U.S. that is used as reference for deciding domestic prices in the country.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook