Japan: Ferrous Scrap Exports Drop 24% in Jan'19

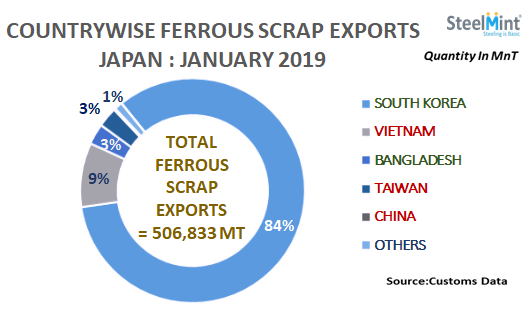

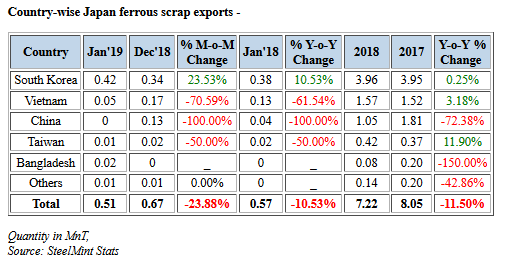

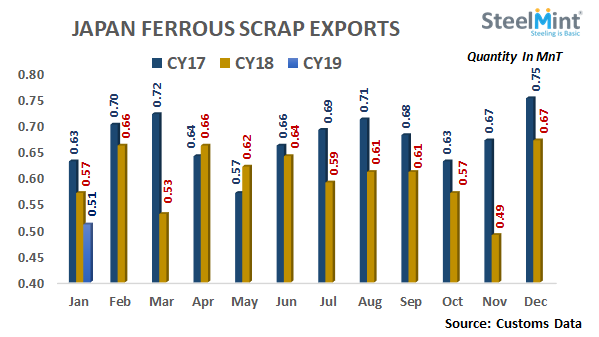

Japan - world's 3rd largest ferrous scrap exporter after EU and US has observed a significant drop in ferrous scrap exports in Jan’19 against exports recorded in Dec’18. As per customs data, Japan exported 506,833 MT ferrous scrap in Jan’19, down 24% M-o-M as against 673,236 MT in Dec’18.

Notably, scrap exports recorded in Dec’18 hit a year high after which Japanese scrap exports could have plunged in Jan’19 amid heavy winter conditions. Also, low generation and sharply declined scrap imports from China and Vietnam ahead of Chinese New Year Holidays in early Feb’19 could have resulted in a decline in exports in Jan'19.

On yearly premises, Japan’s scrap exports dropped 12% Y-o-Y as against 574,924 MT ferrous scrap exports recorded in Jan’18.

South Korea remained the largest importer of Japanese scrap - South Korean steel mills turned active for restocking scrap in Jan'19 witnessing series of bulk cargo bookings from USA, Russia and Japan. South Korea imported 423,223 MT in Jan’19, up 23% M-o-M against 343,034 MT ferrous scrap in Dec’18 occupying highest 84% share. South Korean imports from Japan hit 9 months high in Jan’19 against 442,322 MT imports recorded in Apr’18.

Second largest importer, Vietnam imported 46,956 MT, down 73% M-o-M occupying 9% share. Japan exported 15,003 MT ferrous scrap to Bangladesh in Jan’19 while Taiwan imported 14,555 MT observing stability on a monthly comparison. Malaysia, Indonesia and Thailand witnessed minor imports from Japan in Jan’19.

Chinese scrap imports from Japan lowered significantly hitting a record low 1,555 MT in Jan’19, down 99% M-o-M as against 126,825 MT in Dec’18 and 96% Y-o-Y against 44,225 MT in Jan’18.

Japanese scrap prices remained at lower levels amid limited local demand - Japan’s leading mill kept scrap prices unchanged after a single price cut in Jan’19 amid annual plant maintenance activity. In the export market, average Japanese H2 scrap prices moved further down to JPY 28,000-29,000/MT, FoB levels in Jan'19 against JPY 30,500-31,500/MT in Dec’18. However, scrap prices recovered sharply by JPY 3,000-3,500/MT in Feb’19.

According to the World Steel Association, Japan’s crude steel production recorded at 8.14 MnT in Jan’19, down 4% M-o-M against 8.46 MnT in Dec’18 and down 10% Y-o-Y against 9.03 MnT crude steel produced in Jan’18. Which hit near to 10 years low against 7.66 MnT in Jul’09. On the other hand, domestic consumption of ferrous scrap remained limited resulting in the country’s EAF output to fall by 9% M-o-M to 2.01 MnT in Jan’19.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook