Japan: Tokyo Steel Raises Scrap Purchase Price Further USD 5

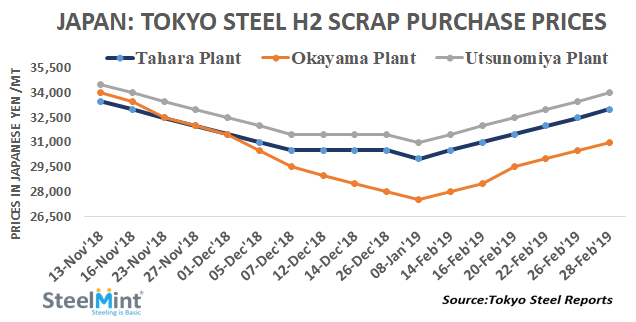

With a recent price hike, the steelmaker has witnessed a sixth successive hike in local scrap purchase price in Feb'19 pulling prices last 3 months high in Japan.

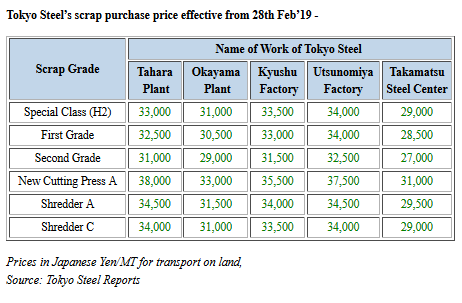

The company will pay JPY 34,000/MT (USD 308) for H2 scrap delivered to Utsunomiya plant situated in the Kanto region. While revised H2 price stands JPY 33,000/MT at the largest plant Tahara in the central area, JPY 33,500/MT for Kyushu works, JPY 29,000/MT at Takamatsu steel center and JPY 31,000/MT at Okayama work.

Prices have increased by a total JPY 3,000/MT at Utsunomiya and Tahara plants while by JPY 3,500/MT at Okayama plant in Feb'19.

The average H2 offers assessed in the range JPY 33,500-34,000/MT (USD 303-308), FoB Tokyo and collection rates in the Gulf region remained in the range JPY 32,000-32,500/MT. Following rising outlook on local scrap prices, Japanese scrap suppliers eye high export offers in Kanto region.

According to prices maintained with SteelMint, Japanese domestic scrap prices maintain upward trend usually during the first quarter of the calendar year. The current Japanese scrap prices are still around JPY 2,000/MT lower against levels that were recorded in Feb'18 last year.

According to SteelDaily's report, South Korean steel market was strong in March month in past three years. However, whether the bullish trend will continue or not will be decided by domestic distribution volume and Japanese scrap price trend. Retailers expect local scrap prices to rise further by KRW 20,000-30,000/MT (USD 18-27) in Mar'19 however, after mid-Mar'19 it may turn again.

Around 242,000 MT of US bulk scrap that was booked in Jan'19 is expected to arrive in Mar'19 in South Korea. On high inventories, Hyundai Steel has not bid for Japanese scrap in the last one month time but participants are waiting for its bidding which will add more clarity.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook