South Korea: Ferrous Scrap Imports Up 15% in Jan'19

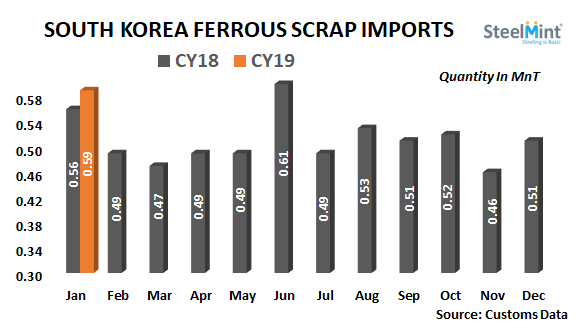

South Korea - world’s 2nd largest ferrous scrap importer after Turkey has witnessed a rise in scrap imports by 15% M-o-M in Jan’19. As per recently released customs data, South Korea imported 590,506 MT ferrous scrap in Jan’19 as against 513,402 MT in Dec’18. On yearly basis, imports climbed up 5% Y-o-Y against 560,045 MT ferrous scrap in Jan'18.

Notably, imports in Jan'19 hit last 7-month high after registering record high imports at 0.61 MnT in Jun'18.

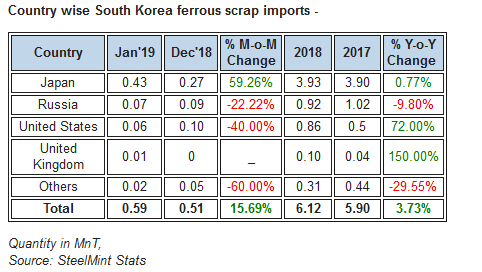

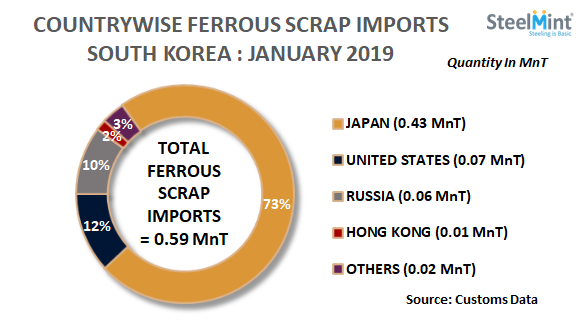

Japan remained the largest ferrous scrap supplier - Japan exported 429,893 MT in Jan’19, up 57% M-o-M as against 274,410 MT in Dec’18 occupying the highest 73% share in total scrap imports. Japanese domestic scrap prices remained low as compared with increased global scrap prices resulting in more purchases from Japan in Jan'19.

US scrap exports could have declined on higher domestic demand and lower collection rates during year-end. US exported 65,995 MT in Jan’19, down 33% M-o-M as against 98,176 MT in Dec’18, it remained the second largest supplier occupying 11% share.

Russia remained the third largest supplier registering 31% M-o-M fall in Jan’19. It supplied 62,656 MT ferrous scrap in Jan’19 against 90,977 MT recorded in Dec’18. New Zealand exported 21,753 MT ferrous scrap however, UK observed nil export volume to South Korea in Jan'19.

South Korean scrap prices fell sharply in Jan'19 - As per Steeldaily’s reports, monthly average prices for Japanese H2 FoB, US mix grade and Russia A3 scrap imported to South Korea stood at USD 295/MT (-USD 10/MT), USD 306/MT (- USD 15/MT) and USD 301/MT (-USD 28) respectively in Jan'19. South Korean leading steelmakers aggressively booked several bulk scrap vessels in mid Jan'19.

Outlook - Following a recovery in global scrap prices, latest US bulk scrap offers assessed at around USD 325-330/MT, CFR. Scrap inventories are likely to remain high on the arrival of bulk cargoes. Also, steel mills remained sidelines to buy Japanese scrap at rising prices and domestic scrap prices have observed correction after rising in Jan'19.

The largest buyer Hyundai Steel resumed open bidding for Japanese scrap last month and expected to raise bids following the jump in Kanto's results in Feb'19.

According to World Steel Association, the country produced 72.46 MnT crude steel during Jan-Dec’18, up 2% Y-o-Y as against 71.03 MnT last year. The country had observed a marginal rise by 4% Y-o-Y to 6.12 MnT ferrous scrap imports in CY18.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Fortuna rises on improved resource estimate for Senegal gold project

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse