Indian Scrap Importers Book HMS Scrap in Decent Quantities

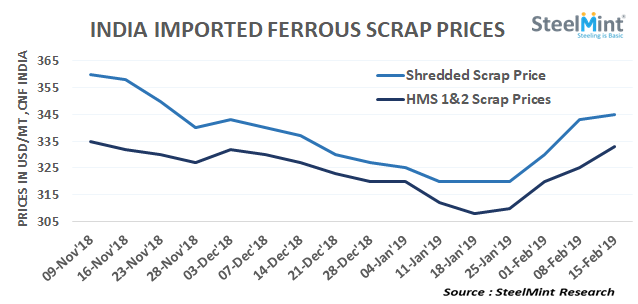

Dubai based containerized HMS 1 sold in containers at around USD 335-340/MT, CFR Nhava Sheva and Mundra, up USD 5-10/MT on W-o-W basis.

SteelMint’s assessment for containerized Shredded from the USA and UK stands at around USD 345/MT, CFR Nhava Sheva, marginally up against the last report. Offers from suppliers were being quoted in the range USD 345-350/MT, CFR but hardly any major deal was reported above USD 342-345/MT, CFR levels for Shredded scrap.

Scrap importers seemed more interested in buying Dubai based HMS scrap for short period delivery (7 days) over long duration shipments.

South African HMS 1&2 sold at around USD 335/MT, CFR. While trades in 20-21 MT containers for West African HMS 1&2 scrap reported in the range of USD 320-325/MT, CFR India.

Export prices for UK HMS 1&2 (80:20) have moved up sharply in last two weeks’ time. Offers for HMS 1 from the UK supplier heard at around USD 335-338/MT and Europe/UK HMS 1&2 assessed at around 325-330/MT, CFR respectively.

Minor trades for Europe and UK origin Bundles concluded at USD 308-310/MT, CFR and European Turning booked at USD 320/MT, CFR Chennai.

Local HMS scrap prices in all major regions have maintained uptrend on firming of Indian Rupee against USD and improved buying from secondary sector on a weekly basis. The price gap between Shredded scrap and HMS has narrowed again.

Price assessment for domestic HMS 1&2 (80:20) stands at INR 25,800-26,000/MT (USD 362-365), ex- Mumbai, up INR 400-500/MT against the last week. Chennai based HMS (80:20) was being reported at around INR 25,200-25,500/MT, ex- Chennai, up INR 500-600/MT on a W-o-W basis, 18% GST extra.

On the other hand, western coastal region domestic HMS (80:20) prices observed correction by INR 400-500/MT against last week to INR 25,900/MT levels, ex-Kandla.

Ship plate prices climbed up INR 800-1000/MT in the first half of this week and corrected by INR 200-300/MT again in the closing of the week. Prices were reported at around INR 32,000-32,200/MT, ex-Alang for 16 mm plate, up INR 600-700/MT W-o-W.

Alang's shipbreaking activities observed renewal of interest with a strengthening of local fundamentals. Participants expect that the market will stabilize shortly and witness some sales as the first quarter of the year has historically been fair for India.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Fortuna rises on improved resource estimate for Senegal gold project

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI