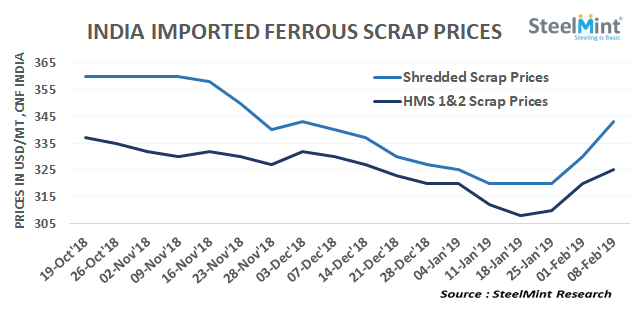

India: Imported Shredded Scrap Prices Move Up in Recent Trades

This has slowed down trades as limited working was reported over the week. SteelMint’s assessment for containerized Shredded from the USA and UK climbs in the range of USD 340-345/MT, CFR Nhava Sheva, up against the last report of USD 330-335/MT, CFR.

In recent trades heard, containerized Shredded scrap was sold at around USD 343-344/MT, CFR from Europe, UK and USA origin. However, few buyers stayed back with buying interest shown at around USD 335/MT, CFR.

Imported scrap prices were supported by increasing local steel prices for billets and rebar.

Indications for Shredded in bulk cargoes has lifted above the levels USD 345/MT, CFR Nhava Sheva.

Dubai based containerized HMS 1 assessed at around USD 330/MT, CFR Nhava Sheva. Middle East HMS heard in the range of USD 325-330/MT, CFR depending on quality.

South African HMS 1&2 assessed at USD 335/MT, CFR. Minor trades in 20-21 MT containers for West African HMS 1&2 scrap was reported in the range of USD 315-317/MT, CFR India.

Offers from UK and Europe rise for HMS - Following rising global prices and higher collection rates, Europe and UK based export offers have jumped sharply this week. Export offers for HMS 1&2 (80:20) is being reported in the range USD 278-280/MT, FoB Europe main port, up by USD 10-15/MT in a weeks’ time. HMS 1&2 (80:20) and P&S from Europe and UK assessed at around USD 325/MT and USD 355/MT, CFR respectively.

Local HMS scrap prices in all major regions have maintained uptrend on improving activities in semi-finish and finish markets on a weekly basis. The gap between Imported and domestic scrap has narrowed down, however price rise of HMS remained slower as compared to Shredded scrap in the imported market.

Price assessment for HMS 1&2 (80:20) stands at INR 25,400-25,600/MT (USD 356-359), ex- Mumbai, up INR 400-500/MT against the last week. Chennai based local HMS (80:20) was being sold at around INR 24,700-24,900/MT, ex- Chennai, up INR 400/MT on a W-o-W basis, 18% GST extra.

In the western coastal region, domestic HMS (80:20) prices climbed up by INR 700-800/MT against last week to INR 26,400/MT levels, ex-Kandla.

Ship plate prices have corrected marginally today after rising by INR 1300-1500/MT over this week. Prices were reported at around INR 31,300-31,500/MT, ex-Alang for 16 mm plate. Alang's shipbreaking activities observed slow movement amid most of the tonnages finding a way to Bangladesh where they are being offered more prices.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Barrick’s Reko Diq in line for $410M ADB backing

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts