Lundin Gold to step up exploration in Ecuador thanks to $38m financing

A syndicate of underwriters, co-led by GMP Securities and BMO Capital Markets, had agreed on a bought deal basis to buy 7.5 million shares at $5.40 each, the company said.

In exchange, the Vancouver-based miner has agreed to grant its backers an over-allotment option, exercisable in whole or in part, to buy up to an additional 1,125,000 shares, or 15% of those sold under the offering.

Lundin expects that Newcrest Mining (ASX:NCM), which already holds about 27% of the miner’s issued and outstanding, will exercise their pre-emptive participation rights.

It also anticipates that Lundin Family Trusts, composed by Zebra Holdings and Investments S.à.r.l, Lorito Holdings S.à.r.l and/or Nemesia S.à.r.l, which collectively have a 23% interest in Lundin, will participate to their collective pro-rata shareholdings in the financing.

Lundin said it intended to use the net proceeds of the offering for exploration on its portfolio of mineral concessions in Ecuador, including the Suarez pull-apart basin, the structure that hosts the Fruta del Norte Gold deposit, and for general corporate purposes.

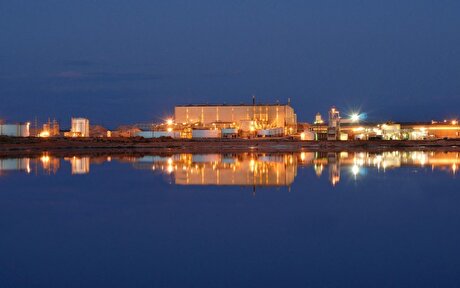

Lundin’s Fruta del Norte, discovered in 2006, is expected to produce to 4.6 million ounces of gold over a 15 year mine life.

Lundin has been developing the asset for almost two years, following an agreement with Ecuador’s government that allowed it to move ahead with the project.

The company acquired it in 2015 for $240 million from fellow Canadian miner Kinross Gold (TSX:K) (NYSE:KGC), which had to halt the project after being unable to reach an agreement with authorities regarding the terms for developing the asset.

The underground gold and silver mine, which will be Ecuador’s largest, encompassing six of Lundin's 29 mining concessions, which cover 70,000 hectares of land.

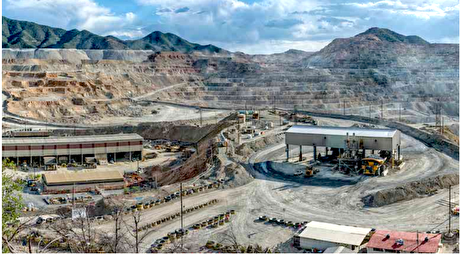

Ecuador has gained ground as a mining investment destination over the past two years, with top miners entering into joint ventures or investing in juniors to gain exposure to projects in that country.

Anglo American (LON:AAL) also landed in the South American nation through a deal with Canada's Luminex Resources (TSX-V: LR). The company plans to develop two copper and gold concessions there.

Currently, Ecuador’s emerging mining sector employs 5,000 people, but estimates the figure will rise to about 16,000 by 2020.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Chile’s 2025 vote puts mining sector’s future on the line

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming