Lithium price: Spodumene is getting crushed

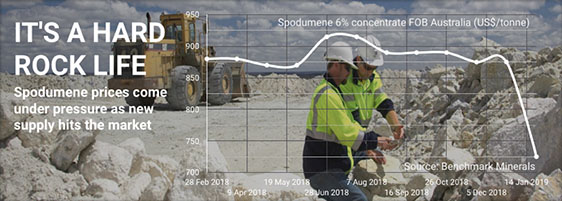

While demand growth continues to accelerate the supply response has been dramatic. Last year saw four new spodumene operations enter the market and while concentrate (6% free on board Australia) traded either side of $900 a tonne for most of 2018, prices fell sharply in January.

According to industry tracker Benchmark Minerals combined output at these operations last year totalled over 175,000 tonnes and ramp up is continuing.

Apart from the new mines, Talison-Albemarle's Greenbushes spodumene mine, the world's largest, is doubling capacity and in January earthworks began on a massive new plant fed by the mine.

Spodumene producers “experienced more pressure as 2018 contracts expired, ushering in a difficult period of negotiation for suppliers, as Chinese converters sought to receive significant discounts due to increased supply” says Benchmark:

With negotiations still ongoing for the limited volumes available outside of offtake agreements, prices as low as $620/tonne have been reported in the market – however this has largely been for small quantities of off-spec material.

The majority of volumes are being traded at $700-750/tonne for 6% Li2O spodumene concentrate, although there could be some further decreases when Chinese buying activity resumes from mid-February onwards.

While generally higher on the cost curve than brine operations, spodumene concentrate is converted into battery-grade lithium hydroxide which trades at around $16,000 per tonne ex-works in China, down from $20,000 six months ago.

Pumping and evaporating brine solution produces lithium carbonate which sometimes requires further refining or conversion to feed into the battery supply chain. Battery-grade lithium carbonate in China has halved in value over the past year and is now exchanging hands for under $12,000 a tonne.

At least the worst may be over for chemical prices says Benchmark:

“While these lower feedstock costs leave room for more reductions in Chinese chemical prices, any further decreases are expected to be marginal with many producers already operating at close to cost.”

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook