Copper price rally halted by Chinese factory surprise

Copper for delivery in March slumped 3% compared to Thursday's close to a low of $2.7535 per pound ($6,070 a tonne) on the Comex market in New York.

A January survey of Chinese private sector factory purchasing managers fell to 48.3 from 49.7 in December, the lowest reading since February 2016 and well below forecasts. A reading below 50 signals contractionary conditions.

The subindex for new orders was the weakest since September 2015, but the outlook for the rest of the year improved slightly, with factory bosses most optimistic since May last year.

The Caixin index focuses on small and medium-sized private sector companies while Beijing's official manufacturing PMI is skewed towards large state owned firms. That reading actually increased last month although it also remains stuck just below 50.

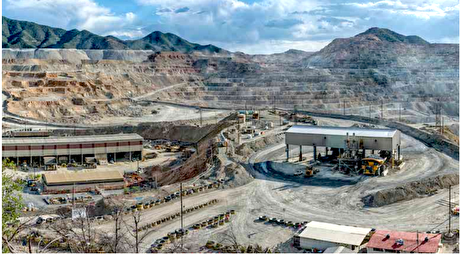

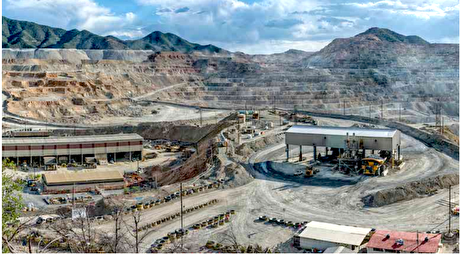

Given its widespread use in construction, transportation and power grid infrastructure, copper is considered a good barometer for economic activity and with China consuming nearly half the world's copper, the price of the red metal is closely correlated with domestic factory conditions.

At the start of 2019, copper fell to a near two-year low of $2.54 a pound over worries about slowing growth in China and fears of the impact of the trade dispute between China and the US.

Most analysts remain bullish on the longer term prospects for copper. Capital Economics, a London-based researcher, says that is partly due to slowing mine supply growth.

Capital Economics believes the metal will average $6,500 per tonne in the first quarter of 2020, after a gradual rise this year.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Chile’s 2025 vote puts mining sector’s future on the line

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming