India: Domestic HRC Prices Under Pressure Over Import Bookings

This week domestic flat steel prices witnessed significant downtrend amid cost effective imports along with dull domestic demand.Traders reported monotonous buying and sluggish trades prevailing in domestic market.

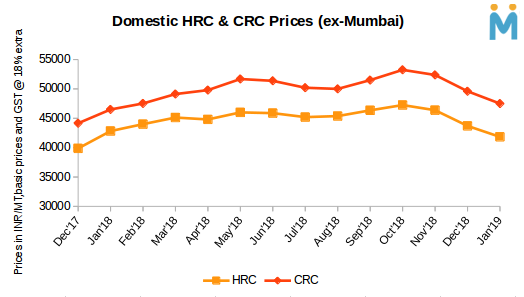

This week domestic HRC prices decline by INR 1000-1500/MT in traders market.Current trade reference prices for HRC (IS2062) 2.5 mm-8 mm is around INR 41,000/MT (ex-Mumbai) and INR 41,500/MT (ex-Delhi). The prices mentioned above are basic prices excluding GST @ 18% on cash payment basis.

This week domestic CRC prices have also corrected by around INR 1500/MT in traders market.Currently trade reference prices for CRC (IS513) 0.9mm is hovering in the range of INR 46,500/MT(ex-Mumbai) and INR 46,000-48,000/MT (ex-Delhi).The prices mentioned above are basic prices excluding GST@18% on cash payment basis.

Why Indian HRC prices are falling constantly in traders market?

1. Parity of landed cost of imports vs domestic offers - Indian steel mills booked around 20,000 MT of HRC from Korea at USD 525/MT CFR basis.As per the calculation,landed cost of HRC to India from South Korea is coming around INR 39,500/MT (ex-Mumbai, GST extra @18%).

However on the other hand domestic HRC prices is hovering around INR 41,000/MT (ex-Mumbai),GST extra @ 18%. Thus imported material is cheaper by INR 1500/MT which is in turn pulling down HRC prices in domestic market.

Also there were some inquiries heard for Ukraine origin HRC at USD 455-460/MT, CFR India. However booking could not be confirmed at the time of publishing this report.

2. Sluggish demand in domestic market- Buyers are hesitant to make bookings as market seems to be on correction mode and end users are expecting further fall in prices.Meanwhile major steelmakers are also providing discounts and rebates to escalate buying in the domestic market.

3. Slowdown in Auto sales in CY18 - As per SIAM,(Society of Indian Automobile Manufactures) reported dull sales due to uneven monsoon, non-availability of credit, poor festive demand, high fuel and insurance costs.

Meanwhile anxiety of elections also affected sales of auto sector.The sales started to weaken after the devastating floods in Kerala, which is the largest market for passenger vehicles followed by Maharashtra.

4. Limited export bookings over falling offers - Indian manufacturers have decline HRC export offers for Vietnam and Nepal in recent deals reported.Last week India exported HRC to Vietnam at USD 480/MT CFR Vietnam for Feb shipments. Last offers was around USD 495/MT CFR basis a month back.

Similarly a major private steelmaker exported HRC to Nepal at USD 525/MT CFR basis for Feb shipments as compared to previous offers which was around USD 580-590/MT CFR in Dec’18.

5. Falling raw material prices -Coking coal prices have sharply moved down by USD 35/MT in a month's time. Premium HCC offers have come down to USD 192/MT, FoB Australia which was at USD 227-228/MT, FoB a month back.

Odisha based merchant miners have sharply reduced iron ore offers to escalate buying interest over increased production. Lump prices have come down by INR 800-1000/MT in last one month.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook