Indian Graphite Electrodes Manufacturers settle Prices for Jan-Mar’19 Quarter at 10% lower - Sources

The current price for UHP grade GE of size 600mm is heard to be around INR 900,000 per tonne (USD 12,643/MT).

This fall in Indian GE prices can be attributed to the ongoing downtrend in Chinese GE prices since the start of winter heating season from mid-November. During this season (Nov-Mar), the steel demand in China takes a backseat and country also imposes production cuts in steel sector which indirectly affects the GE demand (which is a key raw material for steel production via electric furnace route).

China being one of the major GE producing and exporting country, its GE price trend usually affects the global GE prices and thus Indian producers have to take into account the prices in Chinese market while fixing their quarterly contracts.

Another key factor that poses as a threat to the Indian GE manufacturers is the removal of anti-dumping duty on GE imports from China in August last year. This elimination of trade restrictions on Chinese GE imports has increased the risk of Chinese electrodes freely entering into the Indian market.

Apart from this, the Indian steel companies through various associations have requested the Indian government to remove the existing import duty of 7.5% on graphite electrodes (GE). The steel industry has claimed that any kind of import duty on GE does not make any sense in the current market situation as the global electrodes prices have risen dramatically in past one year and the imports do not pose any threat to the domestic GE producers as landed costs of imports are usually at par with the domestic prices.

Despite various binding factors that have compelled the Indian manufacturers to cut down GE prices, a dramatic slash in GE prices is unlikely in the upcoming quarters given the high needle coke prices, the supply of which remains tight in the absence of any new capacity addition or expansion.

Gold price eases after Trump downplays clash with Fed chair Powell

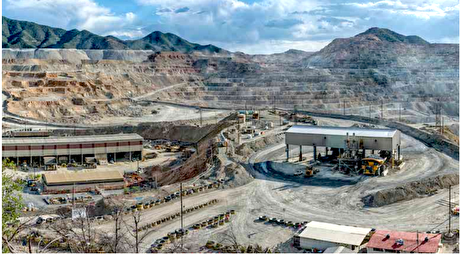

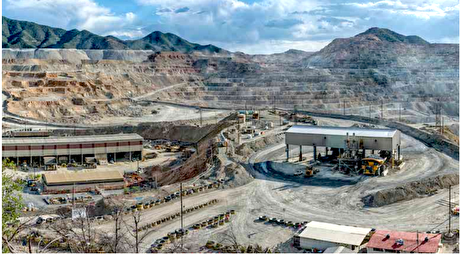

Copper price hits new record as tariff deadline looms

Chile’s 2025 vote puts mining sector’s future on the line

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming