SQM just made it very difficult for Tianqi to access company secrets

The deal, which took months to get approved by Chile’s antitrust regulators, received the okay in October, but under certain conditions. These included preventing Tianqi from naming any of its executives or employees to SQM's board. The company was also told it would have to notify regulators of any future lithium-related deal with either the Chilean producer or its rival Albemarle.

SQM had objected to the extrajudicial agreement on the grounds it did not go far enough to limit Tianqi's access to corporate secrets. On Wednesday evening, the miner revealed its board had approved additional measures to protect corporate data considered confidential. All requests by a board member “appointed by a shareholder who is also a competitor” must now be directed first to the company’s chief executive, and then shared with Chilean anti-trust regulators, it said.

The company’s CEO has the right to deny access to the information requested, but can only do so if ordered by the watchdog.

SQM’s board also plans to form a new, internal Lithium Committee to review documents circulated by the board of directors and related to lithium, including contracts and agreements.

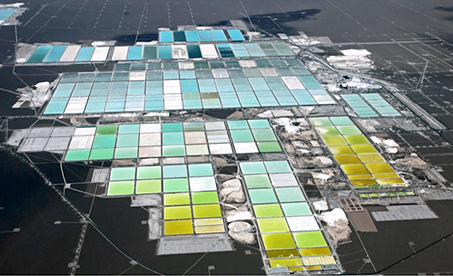

Chile, which holds about 52% of the world’s known lithium reserves, last year lost its top lithium producer crown to Australia. But SQM, Albemarle and the government are working hard to reverse that.

SQM recently finished the first stage of a lithium carbonate ramp-up in Chile’s Salar del Carmen, reaching a capacity of 70,000 tonnes a year. This year, it expects to increase it to 120,000 tonnes a year.

The firm actually believes it will soon overtake US-based competitor Albemarle as the world's top lithium miner by 2022. SQM expects to boost its production capacity that year to 28% of the world's total versus Albemarle's 16%.

Chile expects lithium to soon become its second largest mining asset, just behind copper. It's currently the country's fourth biggest export.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook