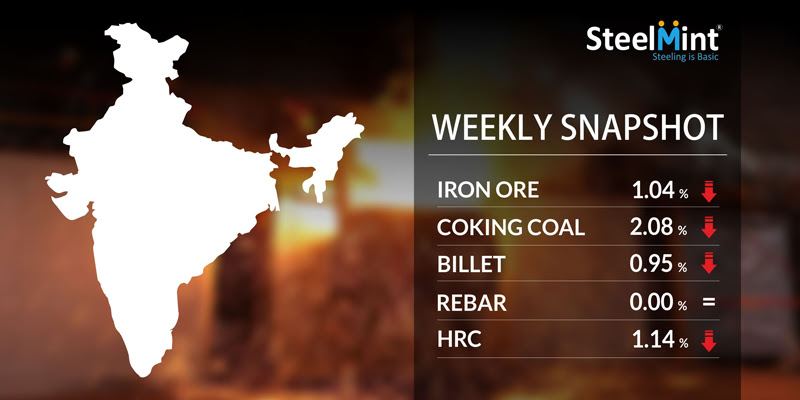

Indian Steel Market Weekly Snapshot

As per SteelMint assessment, the prices of Semi Finished & Finished long products have declined by INR 200-700/MT (USD 3-10). Inline, the Flat steel prices plunged by INR 500-1,000/MT (USD 7-14).

Iron ore & Pellets: According to trade sources report to the SteelMint, few Odisha based major merchant iron ore miners are heard to have further increased discounts on bulk purchase over announced listed offers.

-- NMDC (C.G) Ltd, had announced a second price cut of about 10% in Iron ore for December month and slashed base prices in Karnataka e-auctions by INR 200/MT in fines & INR 100/MT in lumps for auction conducted on 11th Dec 2018.

This week pellet prices in eastern India witnessed some weakness and observed correction, however offers in central India inched up at the beginning of the but later it has been decreased. Pellet offers are stood at around INR 6,400-6,600/MT (ex-Raipur) against the beginning of the week assessment at INR 6,700/MT. Durgapur pellet prices have witnessed minor correction of and are assessed at INR 6,500-6,700/MT this week against last week’s assessment of INR 6,600-6,700/MT.

-- Jindal Steel & Power - concluded an export deal for around 50,000 MT for regular grade pellets (Fe 64%,containing 3% alumina) at around USD 110/MT, CFR China.

Seaborne metallurgical Coal prices have remained mostly stable so far this week amid sustained lackluster demand among buyers in China.

In China, few end-users are interested in seaborne coking coal unless prices dip below USD 200/MT CFR China. However, in the second-tier hard coking coal segment, the Chinese buyers are less pessimistic about the prices due to the relatively tighter supply of materials. Nevertheless, market prices in this segment will fall once more cargoes emerge. Meanwhile, Chinese met coke producers have made a proposal to the steel mills to increase their selling prices for the raw material.

-- Latest prices for the Premium HCC and 64 Mid Vol HCC grade are assessed at around USD 226/MT and USD 186/MT FOB Australia respectively. For Indian buyers, the above offers amount to USD 239/MT and USD 199/MT respectively on CNF India basis.

Scrap: Indian imported scrap market turns silent on weak demand and limited offers this week. Despite the marginal correction in offers, buyers stepped back amid bearish sentiments and less clarity on global prices. Suppliers may turn silent from the next week on seasonality concerns and New Year holidays.

-- SteelMint’s assessment for containerized Shredded scrap stands flat at around USD 340/MT, CFR Nhava Sheva. Limited trades for Dubai HMS 1 concluded at around USD 327-330/MT, CFR.

-- Assessment for South Africa HMS 1&2 stands in the range USD 335-340/MT, CFR and West African scrap at around USD 310-315/MT, CFR

Semi finished: As per SteelMint assessment, the domestic Sponge iron & Billet prices have declined by INR 200-700/MT (USD 3-10). In this period major fall in Sponge & Billet seen in Durgapur by INR 500-700/MT on limited inquiries & strong supply.

-- Indian induction grade billets (100*100 mm) export offers from eastern India, Durgapur hovering at USD 430/MT ex-mill, equivalent to USD 455/MT CFR Raxaul border(Nepal).

-- Indian sponge iron export offers reduced by USD 5/MT W-o-W, price assessment for 78-80 FeM sponge lumps are at USD 325-330/MT CPT Benapole (dry land port of Bangladesh & India) and USD 345-350/MT CFR Chittagong, Bangladesh.

-- Rashtriya Ispat Nigam Limited (RINL)- state-owned steel maker under the Ministry of Steel, has concluded 15,000 MT billet export tender of size 150*150mm (high grade) at around USD 430-435/MT FOB and for 150*150 mm (low grade) at around USD 425-430/MT, FoB, as per sources.

-- Steel Authority of India - a government of India Company has floated the export tender for 16,200 MT billets from its IISCO Steel Plant. The due date for bid submission is 15:00 hrs as per IST on 15 Dec’18.

-- Jindal Steel has further reduced prices by around INR 500/MT and offered Pig iron at INR 29,000/MT ex-Raigarh, Panther shots (Granulated Pig iron) at INR 27,800/MT & Pooled iron at INR 26,800/MT ex-plant, Odisha.

-- RSP (Rourkela Steel Plant) tender held on 10th Dec'18 for sale of about 8,400 MT steel grade pig iron have received good response. The base price of the tender was at INR 27,950/MT and the total quantity have been sold out at INR 28,100-28,200//MT (Ex-plant).

-- NINL extends Pig iron domestic price circular validity till 17th Dec'18 whose due date was 8th Dec'18. Last offers were at INR 28,100-28,500/MT ex-plant, Cuttack, East India.

-- SteelMint's Pig iron export price assessment stood at USD 365-370/MT FoB India, USD 345-355/MT FoB Brazil and USD 355-365/MT FoB Black sea.

Finish Long Steel: As per assessment, Indian secondary rebar market is seeing revival in demand in the last few days after a slowdown. In turn, prices also moved up largely in Raipur upto INR 700/MT, Mumbai upto INR 500/MT & in Hyderabad by INR 300/MT in the last couple of days.

-- Current trade reference rebar prices (12-25 mm) assessed at INR 36,900-37,100/MT Ex- Jalna & INR 35,300-35,500/MT Ex- Raipur. All prices mentioned above are basic & excluding GST.

-- Large steel mills has not announced any further price revision for the December. In the beginning of the month, Major Indian mills has reduced prices and a few increased existing discount by INR 1,000-2,000/MT, depending on quantity & product.

-- The latest price assessment of 12mm rebar through the large players stood at close to INR 42,000-42,200/MT (ex-Chennai, GST extra) and for Wire rod 5.5 mm at INR 44,700-44,900/MT (ex-Chennai, GST extra, SAE1008 grade).

-- Wire rod trade discount offered by the manufacturers/suppliers in Raipur is slightly reduced compared to last week which is now at INR 600-800/MT.

Finish Flat Steel: Indian HRC, CRC prices continue to remain under pressure amid less deals in domestic market. Meanwhile liquidity issues and elections have kept trade activities on lower side. In addition to this, sluggish automobile sales continue to remain another prominent reason for dull sales in domestic flat steel market.

On weekly premises, prices have weakened by INR 500-1,000/MT across major domestic markets.

-- Current trade reference prices for HRC (IS 2062) 2.5 mm-8 mm is around INR 43,500-44,000/MT (ex-Mumbai) & INR 43,500/MT (ex-Delhi). The prices for CRC (IS513) 0.9mm is hovering in the range of INR 49,500-50,000/MT(ex-Mumbai) & INR 51,000/MT (ex-Delhi). The prices are basic, excluding GST@18% & on cash payment basis.

Meanwhile buyers are expecting further downside in domestic HRC prices over slow trades.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook