Will Indian Long Steel Prices Decline Further ?

The Semis manufacturers are forced to cut prices even though the margins (conversion spread) are limited. Similar comments were received from re-rollers as capital of the producers is stuck due to rising stock in the mills.

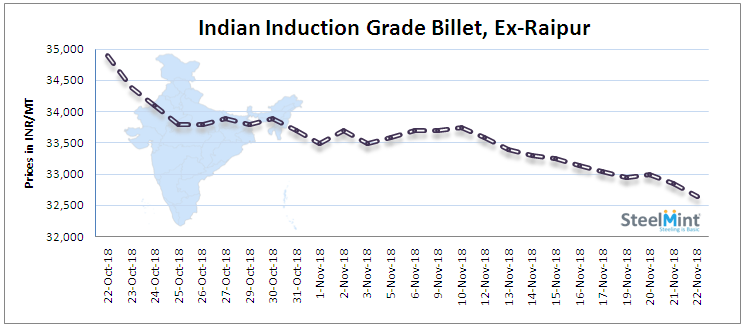

As per assessment in last couple of weeks, the domestic price fall is about INR 500-1,500/MT (USD 7-21) in Semis & Secondary Finished long steel products.

However during the tenure, prices of key raw material such as iron ore, pellet & coal declined marginally by INR 500-700/MT (USD 7-10).

Thus, the cost of productions with standalone mills are more or less firm on limited corrections in raw materials. However as the prices of final products slump, the margins (conversion spread) dipped to bottom line.

On an average the sponge producers in Central & East India are getting conversion is about INR 14,000/MT or USD 198 (from Pellet to P-DRI).

While standalone Billet mills are getting conversion of about INR 12,000/MT or USD 170 (from P-DRI to Billet), while re-rollers are fetching close to INR 3,500-4,000/MT (USD 50-57) conversion from Billet to 12mm rebar.

As per manufacturers the mentioned conversions are not up to the mark (lessened than the required). If the prices fall further, they might curtail productions, which is likely to balance the supply-demand and indirectly support declining prices.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts