15 Things SteelMint Learned from JSW Steel Q2 FY19 Results

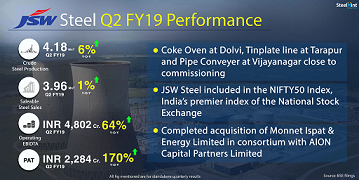

The company reported 6% Y-o-Y increase in crude steel output and 11% growth in domestic sales volume on yearly basis in Q2.

Below are highlights of the conference call conducted:

1.Crude steel output up by 2% Q-o-Q - Company's crude steel output registered growth of 2% to 4.18 MnT in Q2FY19 as compared to 4.11 MnT in Q1FY19. Although in half yearly basis crude steel output stood at 8.30 MnT higher by 6% against 7.86 MnT in H1FY18.

2.Saleable steel sales increased 3% - Company saleable steel sales registered growth of 3% on quarterly basis to 3.96 MnT in Q2FY19 which was 3.83 MnT in Q1FY19. Meanwhile in H1FY19 steel sales stood at 7.79 MnT,higher by 5% against 7.43 MnT in H1FY18.

3.Company’s EBITDA moved up significantly in Q2FY19 - Company’s EBITDA registered the tremendous growth of 64% on yearly basis to INR 4,802 cr as compared to INR 2,927 cr in similar time frame of previous year.However in H1FY19 company’s EBITDA stood at INR 9624 cr which was INR 5125 CR in H2FY18.

4.Company maintains its production and sales guidance for FY19 - Company’s production guidance which was earlier announced at 16.75 MnT and sales guidance is at 16 MnT for FY19 continues to remain unchanged. Company expects to make up in H2 FY19.

5.Domestic and automotive sales witness growth - Domestic sales volume witness the growth of 11% Y-o-Y IN Q2FY19. Meanwhile sales from automotive sector recorded the significant growth of 36% on yearly basis.Branded sales volumes increased by 4% YoY, Retail sales was flat YoY. Also company is expecting significant results in auto sector to be achieved in H2 FY19. Thus higher steel prices amid currency depreciation contributed in achieving growth in sales volumes.

6.Coking coal prices expected to uptick in Q3FY19- Blended Coking coal prices in Q2FY19 is assessed around USD 195/MT CFR India which is expected to increase by USD 10/MT in Q3 FY19.

7.Steel prices to remain flat in coming quarters- In Q2 FY19 , prices remained mostly stable on average basis as in July prices were on lower side and again in the month of September prices gone up. Steel prices are likely to remain range-bound in short term. In last quarter, INR depreciation against USD, tight liquidity position and request for extension of credit period were major concerns in domestic sales.

8.JSW coated steel recorded lower EBITDA- Company’s coated steel product witness lower EBITDA by 38% Y-o-Y in Q2 although prices of Hot rolled coils went up.However prices of downstream products remain on lower side.Also company was expecting exemption on imported slabs in Q2 which unfortunately couldn't be achieved in this quarter.

9. Turnaround plans for Monnet Ispat & Power - JSW Steel has planned turnaround plan for recently acquired Monnet Ispat & Energy Limited in three phases in which currently only DRI unit is operational. In 1st phase JSW is planning to commission pellet, sinter, blast furnace, caster under TMT bar in Q3 FY19. In 2nd phase, company is planning to capacity utilization in line with laid crude steel capacity of 1.5 MnT and in phase-III company may look forward on increasing capacity.

10.Captive iron ore mines in Karnataka to give JSW Steel 5 MnT annual production - JSW Steel participated in recently conducted Karnataka iron ore block auctions. Amid high premiums company acquired one mine out of the five mine blocks awarded in total. JSW won 'Mysore Mineral ' iron ore block which has annual reserves of 9.7 MnT and annual capacity of 0.435 MnT pa.

Of the five iron ore mine blocks JSW won, the company has already commenced production from two mines which will give production of around 0.7 MnT this year. The remaining 3 mines are still not operational amid pending forest clearance issues. If all total 6 mines become operational then annual production of 5 MnT pa is expected to come up.

11.Backward integration projects update - In Q2 FY19, JSW Steel commissioned Pipe conveyor and will get operational in Q3 FY19 which will save iron ore transport cost in Vijaynagar. Also water shedding plant was commissioned in JSW Steel in Q2 which will remove water related problems.

12.Amalgamation of subsidiaries - 4 subsidiaries namely Dolvi Minerals, Dolvi coke, JSW processing centres and JSW Salav Ltd will amalgamate with JSW Steel.

13.Update on Bhushan Power & Steel NCLT process- All resolution applicants, including JSW Steel have submitted their plans to CoC for acquisition of Bhushan Power & Steel on 14th Aug'18 which has then been evaluated. Outcome of evaluation has been given to NCLAT for decission. Cout hearings are going on and next hearing scheduled on 01 Nov'18.

14. Operating costs - Blended iron ore costs increased Y-o-Y due to higher iron ore prices and sourcing mix changes. Ferro alloys, refractory and electrode costs surged sharply Y-o-Y

15. Rising steel imports to India - Escalating trade measures resulting in diversion of steel imports from steel surplus countries into India. India imported 1.58 MnT steel in Q3 CY18 against 1.48 MnT in previous quarter.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook