Pet Coke Import Offers Fall; Domestic Prices Remain Firm in India

Though international pet coke prices were ruling strong from the beginning of this year, Indian market demand for the energy commodity remained subdued as the country’s end-users, mostly cement manufacturers, have been switching to thermal coal or natural gas to avoid pollution issues.

Potential for restrictions on pet coke usage and lingering uncertainty over changing domestic regulations in the first half of this year have subdued demand for seaborne petroleum coke largely exported from the US Gulf Coast. Indian cement makers are seen buying US thermal coal to replace the petroleum coke that they use as a power source for their kilns.

With the viability of pet coke imports under threat, Indian buyers have been unwilling to risk their cargoes being turned away upon arrival at the port. So, they have limited their purchases of pet coke, and instead turned towards thermal coal as a substitute.

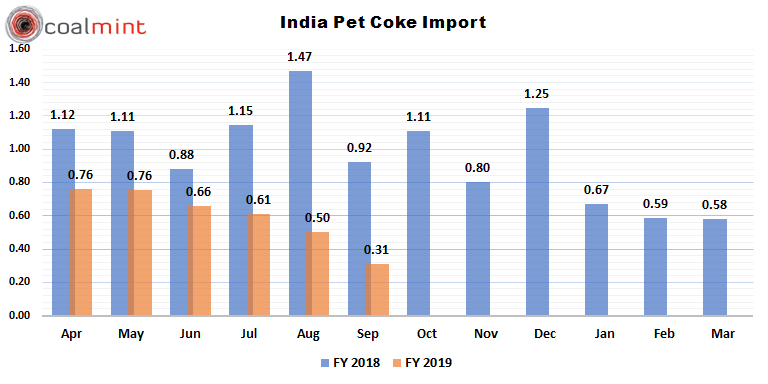

Consequently, Indian petroleum coke imports have fallen every month since the start of this fiscal, as the country’s apex court aimed at reducing toxic emissions from the polluting oil refinery by-product.

As per the vessel lineup data compiled by CoalMint Research, India’s pet coke imports have decreased by 38% M-o-M to 0.31 MnT in Sep’18, against 0.50 MnT in Aug'18.

PRICE ASSESSMENTS

The latest offers for pet coke (6.5% Sulphur) from USA are assessed at around USD 102/MT CNF India, while offers for pet coke (9% Sulphur) from Saudi Arabia are assessed at around USD 98/MT CNF India.

Currently, Indian domestic prices of pet coke are INR 9,650/MT (Reliance Industries Ltd.) and INR 8,370/MT (Mangalore Refinery and Petrochemicals Ltd.).

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

SQM boosts lithium supply plans as prices flick higher

Nevada army depot to serve as base for first US strategic minerals stockpile

Pan American locks in $2.1B takeover of MAG Silver

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook