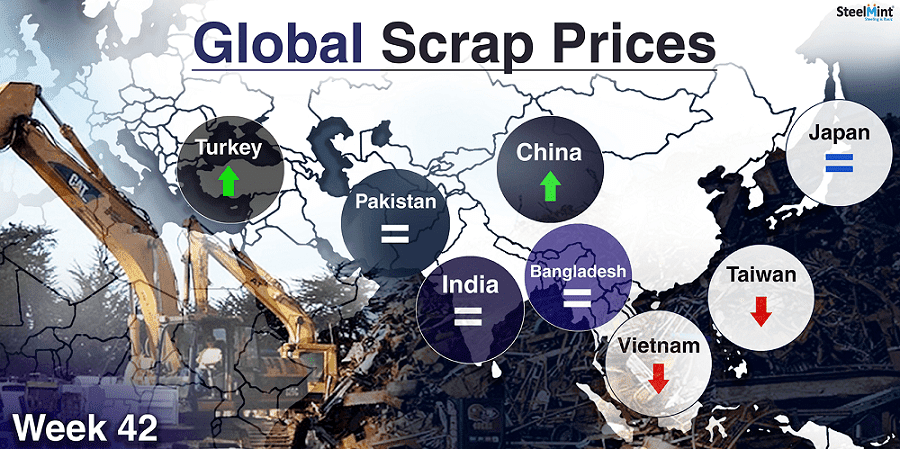

Global: Ferrous Scrap Market Overview - Week 42, 2018

Turkish scrap prices remain supportive for European and Baltic region cargo trades. Japan's domestic prices stop climbing up after long period and expected to have reached short term peak. South Korean steelmakers booked Russian bulk cargoes. China’s Shagang steel raised scrap purchase prices by USD 9-12 due to upcoming production cuts and improved billet prices in the spot market. East Asian markets like Taiwan, Vietnam and Thailand remained comparatively active for imported scrap as prices showed downward correction. Indian imported scrap bookings remain slow amid local festive holidays and depreciated currency. While Pakistan and Bangladesh observed limited purchases at almost stable prices.

Turkish scrap importers book 3 cargoes in recent deals - Despite recent softening of global scrap prices, Turkish scrap prices remain supported on positive outlook after rebounding during the beginning of the week. Finish steel demand remains slow amid few sales reported with appreciating Lira. A steel mill in the Izmir region booked a Baltic Sea cargo for November shipment, comprising of 18,500 MT of HMS 1& 2 (80:20) at USD 327.50/MT and 3,500 MT of Bonus at USD 337.50/MT, CFR. According to SteelMint’s price assessment, USA origin HMS (80:20) scrap stands at around USD 332/MT, CFR Turkey, marginally up by USD 2-3/MT W-o-W. While HMS 1&2 (80:20) for European origin heard at USD 324/MT, CFR.

Japanese domestic scrap prices stable - Japan’s domestic demand slowed down this week as prices seem to have reached short term peak. Few EAF likely to cut scrap prices ahead of plant shutdown amid electricity supply cut. Tokyo steel’s H2 scrap prices stand stable at JPY 39,000/MT (USD 342) at Kyushu plant and at JPY 38,500/MT at Okayama. Japan’s H2 export prices assessed at JPY 36,500-37,000/MT, FoB in recent deals.

China’s Shagang Steel scrap prices hit 1 year high - Eastern China’s leading scrap consumer Shagang Jiangsu Steel group has raised its domestic scrap purchase prices by RMB 60-80/MT after keeping prices unchanged for more than one and half months’ time. Shagang is now paying 1 years’ high price of RMB 2,700/MT (USD 390) inclusive of 16% VAT for HMS (6-10 mm in thickness) delivered to Zhangjiagang works. Following Shagang’s lead, other major steelmakers like Maanshan and Xingcheng have also raised scrap prices by RMB 70-80/MT ahead of production cuts in the country, tightening supply of scrap and rising billet prices.

South Korean Steel mills booked Russian bulk scrap contracts - Hyundai Steel and Dongkuk Steel booked Russian A3 grade scrap in bulk cargoes as local prices remained high. Dongkuk Steel booked 43,000 MT of A3 at USD 350/MT, CFR While Hyundai booked cargo at USD 348/MT, CFR South Korea. HMS (80:20) sold at around USD 355/MT, CFR. Disparity between South Korean mills price expectations and Japan’s scrap export prices kept Japanese scrap buying limited.

Vietnam scrap prices slide further, demand remains decent - Vietnam scrap importers observed correction in prices on dull demand. Offers for UK and Australia based containerized HMS 1&2 (80:20) heard around USD 345-350/MT, CFR. Hong Kong based containerized HMS 1&2 (50:50) traded at USD 345/MT, CFR Vietnam down USD 5 W-o-W basis.

Taiwanese scrap prices move down amid recent deals - Price assessment for USA origin HMS (80:20) stands at USD 328/MT, CFR Taiwan in containers, down USD 6/MT as against USD 334/MT, CFR W-o-W. Offers for USA HMS (80:20) heard in the range of USD 333-335/MT, CFR while Japanese bulk HMS 1&2 (50:50) in the range of USD 355-360/MT, CFR.

Indian scrap market observes slow movement - Indian imported scrap booking remained very slow amid local festive holidays and depreciated currency this week. Prices corrected marginally down on slowdown in the demand amid limited deals concluded despite firm global levels. Local scrap being cheaper remains a preference for few steelmakers over imported.

Shredded scrap from UK and Europe traded in containers in the range of USD 355-360/MT, CFR Nhava Sheva. While limited offers heard for Dubai and South African HMS 1&2 containerized scrap in the stable range of USD 335-345/MT, CFR Chennai on W-o-W basis. West African HMS 1&2 in containers traded this week at around USD 320-330/MT, CFR Chennai. Local HMS 1&2 (80:20) basic prices assessed at INR 25,400-25,600/MT (USD 346-347), ex-Mumbai stable on W-o-W basis.

Pakistan scrap market turns quiet, buyers adopt 'wait & watch' approach - Containerized Shredded 211 from Europe and UK origin was traded at USD 353-358/MT, CFR Qasim. Few offers being quoted even at around USD 360/MT however buying interest remained slow. South African HMS heard in the range of USD 345-350/MT while HMS 1 from Dubai assessed at around USD 343-345/MT, CFR Qasim. After rising sharply local steel prices for billet and rebar heard almost firm. Electricity prices observe an increase PKR 3.75-3.82 per unit which may push local steel prices upward depending on acceptability from customer’s side. On 14th Oct, at least seven workers have been reported injured after a fire broke out inside a non-operational oil tanker at Gadani shipbreaking yard.

Bangladesh market remains less active, prices range bound - Very limited deals heard at almost range bound prices as no major deal was reported this week in Bangladesh. Offers were hovering by the range of USD 10/MT and buying interest stood below USD 5-10/MT than current prevailing levels. Containerized Shredded 211 from Canada was being quoted as high as around USD 380/MT, CFR Chittagong. While limited offers for UK/Europe origin Shredded assessed in the stable range of USD 370-375/MT, CFR. Local scrap and ship breaking plate prices remain stable while Indian sponge iron export offers heard USD 350-355/MT, CFR. Ship cutting market continued to dominate the overall purchasing trend in Asian region as two sales reported at decent prices in Chittagong.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook