Turkey Fixes Quotas on Steel Imports and also Announces Provisional Tariffs above the Set Limits

Duty-free Import quotas are the limitations on the quantity of products that can be imported into a country without any tariffs during a specified period of time.

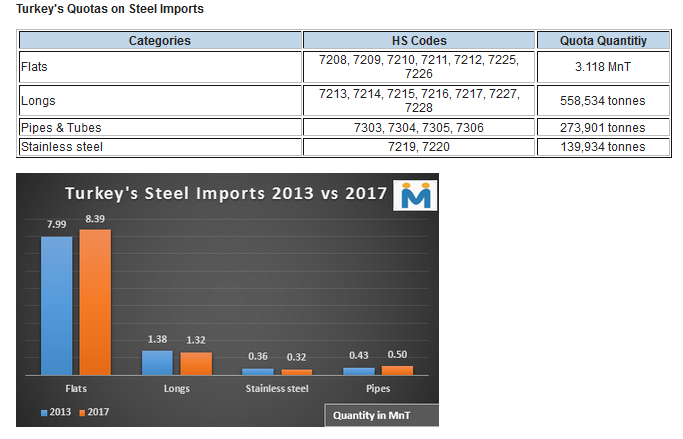

The annual duty-free quota for imports of flat products under HS code 7208, 7209, 7210, 7211, 7212, 7225 and 7226 have been set at 3.118 MnT. The long products that come under HS code 7213, 7214, 7215, 7216, 7217, 7227 and 7228 have a quota of 558,534 tonnes, while pipes and tubes that comes under codes 7303, 7304, 7305 and 7306 have a quota of 273,901 tonnes. Imports of stainless steel products under codes 7219 and 7220 have a 139,934 tonnes quota.

Some of the above products already have trade barriers in place in case of imports from China. This includes 16.89-22.5% anti-dumping duties (ADD) on some flat products and USD 100-120/MT ADD on seamless pipe imports.

Turkey has launched a safeguard investigation into imports in April last year and the final decision of provisional tariffs has come now from Turkey’s customs and trade ministry amid growing steel imports in Turkey due to protectionist measures by major economies such as U.S, and European Union which has made key steel-producing nations to find and dump their excess quantities in other markets.

The total imports of products on which quotas-tariffs system has been implemented stood at 10.6 MnT in 2017 against 10.2 MnT in 2013 (2013-2017 was the period under investigation). While imports of flat products rose 5% over this period to 8.39 MnT and pipe imports grew 17% to 506,000 tonnes, long products import fell -4% to 1.32 MnT and stainless steel inflow from foreign countries dropped -10% to 332,000 tonnes. Out of Turkey’s above-mentioned steel products consumption of 25 MnT, imports took a 41% share of Turkey’s market in 2013, while in 2017 consumption was 31 MnT and import market share fell to 34%.

With the new safeguard measures, Turkey’s flat products imports are likely to be hit hardest since Turkey imports more flats than any other steel product category.

During Jan-Jul’18 Turkey imported 2.63 MnT of hot rolled flats under HS code 7208, 512,600 tonnes of cold rolled flats under HS code 7209 and 513,296 tonnes of coated flats under HS code 7210. Russia is the largest supplier of the first two categories, while South Korea supplies the most coated coil. However, during this period, Turkey’s total flat products import fell -1% to 4.9 MnT but long products import rose 7.5% to 895,000 tonnes against the corresponding period of the previous year.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook