Iran : Domestic Billet Prices Slide Down Post New Government Measures

According to the letter issued by Deputy Industries Minister Jafar Sarqeini, the prices of steel products on IME will be equivalent to the average rate of discovery of goods in the last four offers on the market, thus removing the ceiling on commodity trading for steel products.

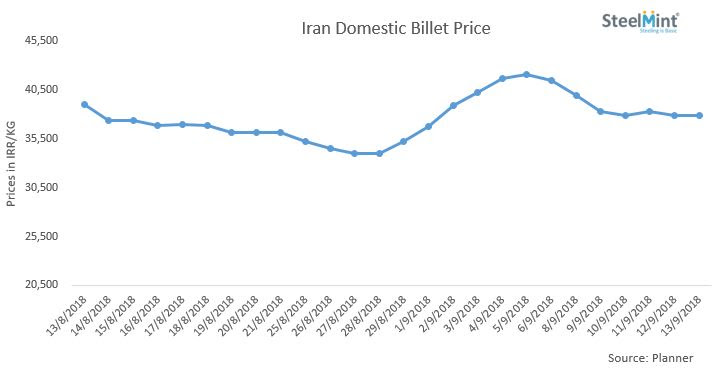

The discovery of new prices is in accordance with the proposal made by four major steel companies of Khorasan, Khouzestan, Mobarakeh and Esfahan. Owing to this rule the billet price in spot market started to decrease rapidly.

According to Planner “After the new rule at IME, the market is sliding downward, since the prices at IME are being stabilized and speculative demand has been eliminated.”

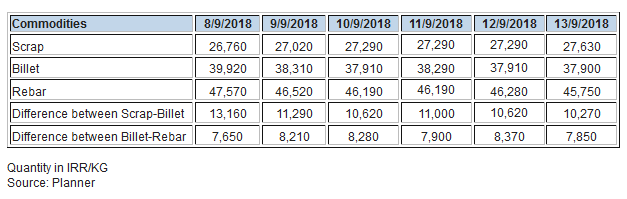

As per SteelMint assessment, market opened on 8th Sep’18 with a billet price of IRR 39,920/KG (USD 950/MT) and started decreasing from the next day by reaching IRR 37,910/KG (USD 903/MT) on 10th Sep’18. During the mid of week billet prices were noted to be around IRR 38,290/KG (USD 912/MT). Towards the weekend billet prices were hovering at around IRR 37,900/KG (USD 902/MT).

It is to be noted that Iranian steel market is not active in current week owing to Moharram.

Khouzestan Steel, South Kaveh Steel and Khorasan Steel Offered Billet/Bloom at IME

Khouzestan Steel, one of the giant billet producer sold 30,000 MT bloom at IME for IRR 34,302/KG (USD 817/MT) against the demand of 41,000 MT on 15 Sep’18

South Kaveh Steel sold 12,000 MT bloom at IME for IRR 35,755/KG (USD 851/MT) against the initial demand of 33,000 MT.

Khorasan Steel also sold 5000 MT bloom at IME for IRR 33,763/MT (USD 804/MT) against the demand of 9000 MT.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook