Chinese Steel Market Highlights - Week 37, 2018

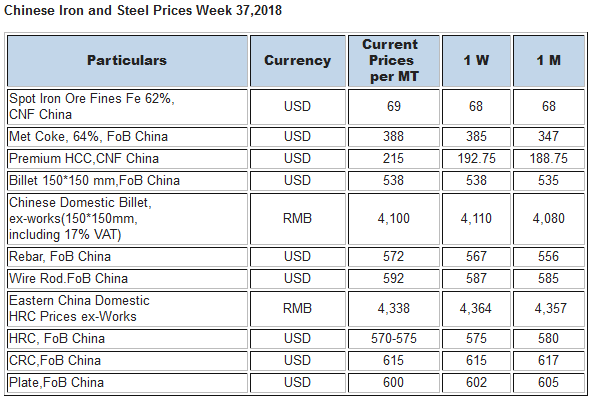

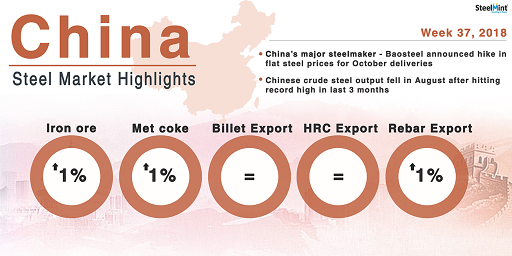

Meanwhile flat steel export offers remain stable. Rebar export offers witness uptrend amid gains in domestic market. Coking coal offers rose over tight supply.Iron ore prices moved up towards weekend.

China’s major steelmaker - Baosteel announced flat steel prices for October deliveries. The company has raised HRC prices by RMB 100/MT in and CRC prices by RMB 100-150/MT (USD 15-22) for October deliveries.

According to National Bureau of Statistics (NBS) China’s crude steel output inch down by 1% M-o-M in Aug’18 to 80.33 MnT which was 81.24 MnT in Jul’18.However on yearly basis the same grew by 8% in Aug’18 which was 74.59 MnT in Aug'17.

Chinese spot iron ore prices move up towards weekend - Chinese spot iron ore prices opened up this week at USD 68.55/MT, CFR China and increased to USD 69.25/MT, CFR China towards the week end. The prices picked up with an anticipation of relaxation in output curbs by Chinese government.

Iron ore inventory at major Chinese ports have reduced to 149.50 MnT as against 149.80 MnT, last week.

Spot lump premium has increased by USD 0.0057/DMTU this week to USD 0.3417/DMTU. Lump inventory at Chinese major ports recorded at 21.20 MnT this week, as against 21.40 MnT a week before amid strong demand for pellet over lump premium.

Spot pellet premium for Fe 65% dropped to USD 0.65/DMT and is assessed at USD 88.90/DMT, CFR China this week, against USD 89.55/DMT last week.

Coking coal offers spike amid tight supply - Seaborne coking coal offers moved up this week owing to lesser availability of low sulphur of coking coal in domestic market. Thus Chinese suppliers continued paying premiums for low volatile coking coal cargoes with high CSR, relatively lower ash and sulphur content.

Meanwhile demand for coking coal from India likely to increase amid end of monsoon season and increase in construction activity in near term.

Currently Premium HCC prices surge by USD 19/MT W-o-W basis and are assessed around USD 208.50/MT FoB Australia. Last week the offers was in range of USD 189/MT FoB basis.

Chinese domestic billet prices fall marginally- Domestic billet prices in China have come down throughout this week. Current spot price assessment is at around RMB 4,100/MT (including VAT) for 150*150mm billet Q235 against RMB 4,110/MT in last week. Chinese billet export price assessment remained mostly stable at W-o-W at USD 535-540/MT, FoB basis.

Chinese HRC export offers remain stable over dull demand- Chinese HRC export offers remain firm amid lackluster demand prevailing among overseas buyers.Thus HRC export offers continue to remain on lower side in line with falling domestic prices.

Currently Chinese HRC export offers heard around USD 575-580/MT, FoB China. Payment made on letter of credit basis for 1,000-10,000 MT.Buyers are bidding on lower side which is around USD 570-575/MT FoB basis.

Prices of HRC in the domestic market are gauged at RMB 4,320-4,340/MT (ex-works) in Eastern China and RMB 4,230-4,240 /MT in (Northern China).

Chinese Re-bar export offers witness uptrend this week-This week Chinese rebar export offers witness uptrend amid gains in domestic market.

Currently,Chinese re-bar export offers are at USD 572/MT FoB China.Last week the offers was hovering in the range of USD 567/MT FoB basis.

Major mills are offering continue to offer at USD 605/MT FoB China.However end users are bidding on USD 550-560/MT CFR.

Domestic rebar prices stood at RMB 4,500-4,540/MT in (Eastern China) up by RMB 30-40/MT D-o-D basis and RMB 4,350 - 4,380/MT in (Northern China) up by RMB 10/MT,D-o-D basis.

However buyers remain cautious amid uncertainties regarding winter production cut in China.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Barrick’s Reko Diq in line for $410M ADB backing

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts