Bangladesh: Imported Scrap Market Observes Slowdown; Offers Up

However, the market has slowed down majorly on lesser availability and allocation of funds due to upcoming parliamentary elections in the country towards end of December. Couple of limited quantity deals have concluded in containers but finish steel demand has not picked up fully in the local market. Most of the steelmakers have already booked scrap for Oct-Nov months.

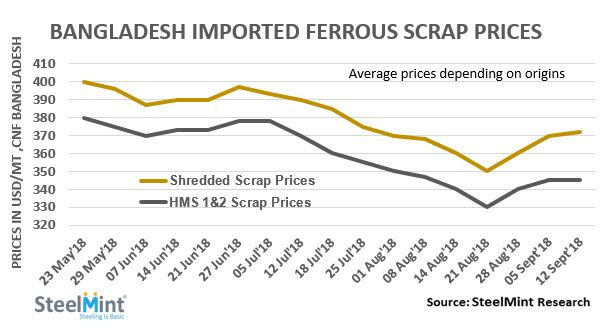

In recent deals heard, around 3000 MT of Shredded scrap from Europe booked at USD 365/MT, CFR Chittagong. Shredded 211 scrap in containers from UK & USA suppliers is being offered at around of USD 370-375/MT, CFR. However, bidding from buyers still stands at around USD 365-367/MT, CFR. South Africa origin P&S scrap is being quoted mostly stable at around USD 367-372/MT, CFR Chittagong.

HMS 1 offers assessed stable at around USD 363-365/MT, CFR levels from UAE and South Africa. Buyers are getting offers at USD 335-340/MT for HMS 1&2 (80:20) from Brazil, Chile and UK. While bulk cargo offers remain high on steady sentiments from seller’s end.

Bangladesh local scrap prices remain on lower side - Indian sponge export offers to Bangladesh have remained strong and assessed at around USD 390/MT following strong fundamentals. Increased prices for Indian sponge iron and firm prices for imported scrap in the global market is resulting in shifting interest to local scrap. Local scrap prices equivalent to P&S scrap heard at BDT 35,500-36,000/MT (USD 425-431) while ship breaking local HMS scrap prices heard at BDT 34,000-34,500/MT inclusive local taxes, down BDT 500/MT W-o-W and remain cheaper over imported. Ship cutting plate prices assessed at BDT 41,300/MT for 16 mm, at BDT 40,300/MT for 12 mm and BDT 42,800/MT for 20 mm & above.

Local steel market subdued on heavy rains this week - Activities in the domestic market were expected to pick up ahead of completion of monsoon. However, the country witnessed heavy rains this week which is turning market subdued for time being. Construction activities remain stagnant impacting finish steel demand and rising stocks at plants have resulted in downward pressure on rebar prices for medium scale producers.

Bangladesh ship breaking market observes speculative sales – Bangladesh buyers observed sales of VLCC (48,100 LDT) and Capesize bulker (20,489 LDT) at firm levels of USD 438.5/LDT and USD 437/LDT respectively. No other market was that supportive to resale of VLCC except Bangladesh in all subcontinental markets. Market is likely to turn active for rest of the calendar year with gradual consumption of units fetched earlier. Prices assessed at USD 420/LDT for general dry bulk cargo, at USD 430/LDT for tanker cargo and at USD 440/LDT for containers on CNF Bangladesh basis.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook