Middle East Bank Tracks Q3 Stock Market Trends

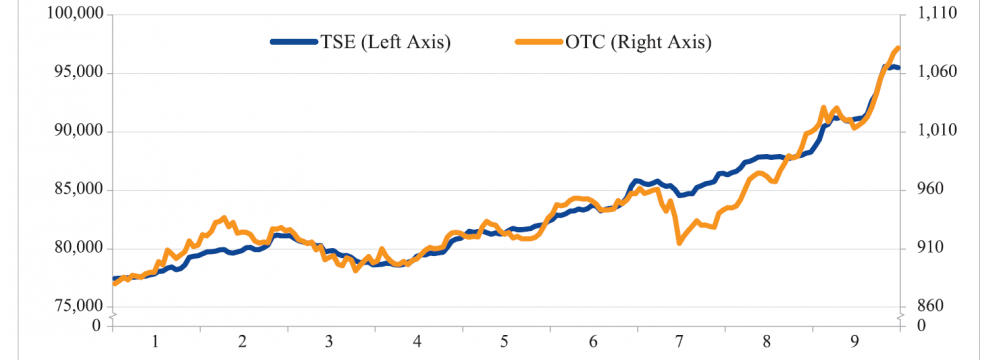

The total value of TSE transactions in Q3 amounted to 134.5 trillion rials (about $2.9 billion), including debt securities worth 19.9 trillion rials ($428 million).

The over-the-counter market Iran Fara Bourse’s index closed Q3 at 1,082, showing a 13% rise from the beginning of that quarter and 22.9% rise from the beginning of the year.

The total value of OTC transactions amounted to 161.1 trillion rials ($3.4 billion), exceeding TSE’s, out of which 105.3 trillion ($2.2 billion) belonged to various types of debt securities, including Islamic Treasury Bills, participation bonds, Murabaha and mortgages.

The seventh batch of “banking” ITBs valued at 35 trillion rials ($753 million), issued at the end of the last fiscal year and admitted in the late Q2 of this year, became tradable at IFB in early fall and will mature at the end of the next fiscal year. These bills, which had to be previously traded directly between the buyer and the seller in selected branches of Melli Bank, became tradable at the OTC market and are not referred to as “banking” bills anymore.

After ceasing the issuance of ITBs late last year, another series of these bills amounting to 28 trillion ($602 million) were issued in the sixth and eighth months of the current year by the Ministry of Economic Affairs and Finance. These two series with one-year maturity were admitted at OTC market in the middle of fall and their tickers opened in the last days of that season.

Four-year Murabaha bills with six-month interest payments at the rate of 17% aimed at financing medical equipment purchases valued at 20 trillion rials ($430 million) and issued in fall by the same ministry were admitted to IFB at the end of fall.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Fortuna rises on improved resource estimate for Senegal gold project

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse