TEDPIX Gains 2.8% in Weekly Trade to Notch Record High

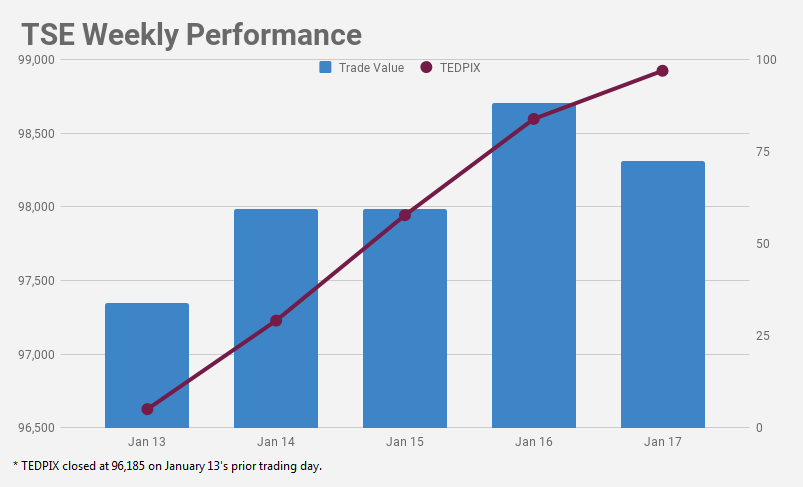

Tehran Stock Exchange’s main index TEDPIX gained 2,738 points or 2.8% in the past trading week that ended on January 17 to close at an all-time high of 98,923.6.

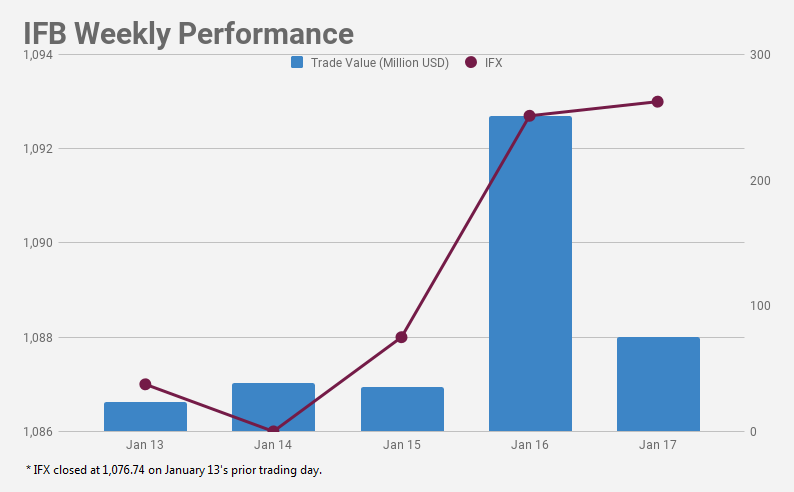

The main index of the smaller over-the-counter exchange Iran Fara Bourse added 16.4 points or 1.5% during the week to stand at 1,093. IFX is currently at its three-week high and will only need a few points to break past its December 25 record of 1,105.

Political Risks Diminish, Yet Persist on Horizon

The main systematic risk muffling trade for this month’s first three trading weeks was US President Donald Trump’s January 12 deadline to continue waiving US nuclear sanctions on Iran as part of the landmark deal reached in 2015.

The deal, also known as Joint Comprehensive Plan of Action, had come under threat by the Trump administration before, and the risk sent investors to their bunkers every time.

Trump did eventually extend the waiver of key sanctions, yet sent an explicit warning to Europe that the deal must be fixed to his liking by the time the sanctions waiver's deadline is due in spring.

The declaration puts great pressure on Britain, France and Germany, the European signatories to the nuclear pact with Iran. The US wants them to help devise a new agreement, while Iran has said it’s not interested in any renegotiation.

By mid-May, Trump will again have to deal with extending sanction waivers on the Central Bank of Iran and Iran’s oil and gas sectors. The best- and worst-case scenarios are obvious, and observations so far lean toward the worst, making the EU’s decision to choose sides a vital one for Iran.

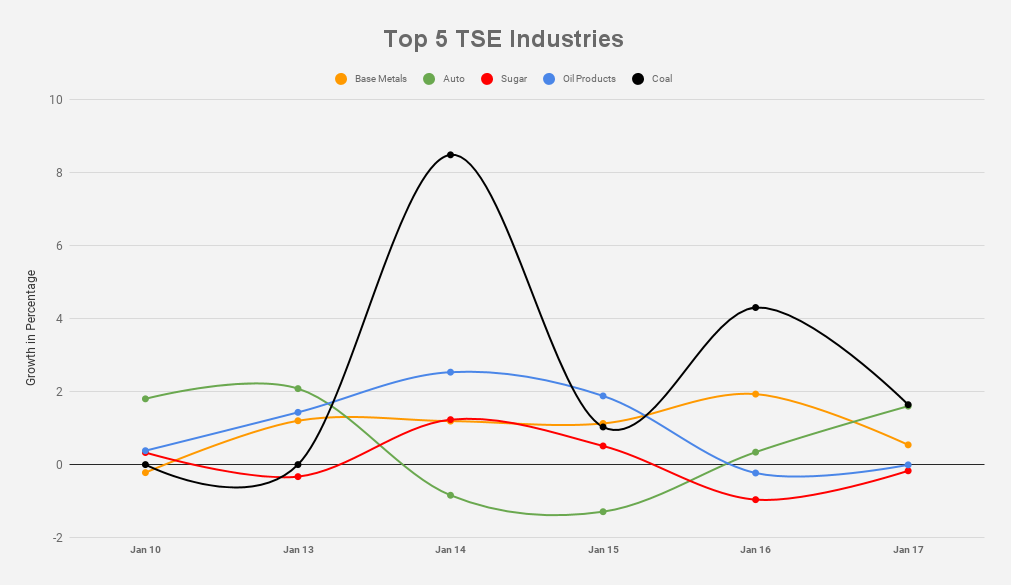

Base Metals Lead TSE Growth

Nevertheless, base metal shares gave the biggest boost to TEDPIX last week while boasting the highest trade value.

Mobarakeh Steel Company was at the forefront with its shares growing 7% to 3,100 rials during the week. Other steelmakers also followed suit.

However, metal producers such as Calcimin Company, National Iran Copper Industries Company and Iran Aluminum Company could not sustain their gains for the week and ended lower.

Petrochemicals came second in weekly trade value and benchmark boost. Oil prices have more than doubled in two years and the government’s recent announcement regarding liberalization of urea prices in Iran Mercantile Exchange attracted investors to petrochem shares in droves.

Always responding to JCPOA-related developments, auto shares were also on the rise last week. The growing attraction of commodities did not allow them to have much action, but the slight setback in global prices as of Tuesday sent chunks of capital their way.

Weekly Trade in Detail

Over 5.13 billion shares valued at $283.6 million were traded on TSE last week. The number of traded shares and trade value dropped by 4% and 1% respectively compared to the previous week.

Trading at Iran’s stock markets starts on Saturday and ends on Wednesday.

TSE’s First Market Index gained 2,482 points or 3.6% to end at 70,710.1. The Second Market Index rose by 5,886 points or 2.8% to close at 214,918.9.

And at IFB, with a 24% share of weekly trade, chemical shares were the market leaders, followed by base metals with 13%.

Over 2.02 billion securities valued at $423.7 million were traded at the over-the-counter exchange. The number of traded shares dropped by 0.2% and trade value surged 154% compared to the previous week.

IFB’s market cap lost $126.3 million or 0.4% to reach $28.39 billion.

Its First Market witnessed the trading of 321 million securities valued at $14.06 million, indicating a 107% and 153% surge in the number of traded securities and trade value respectively.

About 483 million securities valued at $32.92 million were traded in the Second Market, with the number of traded securities shrinking by 7% and trade value rising 14% week-on-week respectively.

Over 15 million debt securities valued at $325.7 million were also traded at IFB, growing 266% and 278% in the number of bonds traded and their value respectively.

Exchange-traded funds also grew 45% in trade number with a slight downtick in value to reach 38 million worth $13.7 million.

Housing mortgage bonds’ trade, however, marked a downturn as it reached 35,000 securities worth $5.8 million, down 1% in both counts.

Stocks Trail Euro in ROI

Fluctuations in foreign exchange and gold markets propelled euro to the top of investment options in terms of returns on investment, both weekly and so far in the current fiscal year (ending March 20.

TSE has posted a 28% ROI so far this year, while the figure stood at 20.7% for IFB. Both markets’ gains this week revitalized them, as they lagged behind other markets in the last three trading weeks due to lackluster performance.

The rial was quoted at 55,720 against euro by Thursday’s close, according to Tehran Gold and Jewelry Union. It marked a 2.7% growth for the European currency and marked the week’s highest ROI.

Euro’s ROI so far this year reached 35.5%, having started the year at 41,120, trumping other markets in returns so far this year.

US dollar, on the other hand, gained 0.97% against the rial this week to 44,580. Its ROI so far this year reached 18.94%, having started the year at 44,150.

As for gold, Bahar Azadi gold coin also rose 0.62% last week to 14.6 million rials. Its total ROI so far this year stood at 23.7%.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Fortuna rises on improved resource estimate for Senegal gold project

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse