Iran Semis Exports Up 84% as Finished Steel Plunges

Billet and bloom made the bulk of semis exports during the period, reaching 2.32 million tons, up 46% YOY. Slab shipments were next, growing 171% YOY to 1.9 million tons.

Extending this year’s market trend were finished steel products, marking a continuous drop in shipments. Exports shrank 35% to 940,000 tons for the eight-month period.

Hot-rolled coil was the main exported commodity in this sector with 373,000 tons, dropping 60.1% YOY. Less than 3-mm HRC exports, however, jumped 1,900% to 19,000 tons for the period, while thicker materials were still down.

Rebar exports came next with 358,000 tons, followed by beams with 113,000 tons, “other steel products” with 46,000 tons, coated coil with 43,000 tons and cold-rolled coil with 7,000 tons. Beams and CRC were the only commodities posting a downturn in shipments.

Steel exports are expected to reach 8 million tons in the current fiscal year (ending March 20, 2018), according to former industries minister, Mohammad Reza Nematzadeh.

The most significant uptick in shipments, however, was recorded for direct-reduced iron, with Iran as the largest producer of the commodity in the world facing a considerable surplus of the material.

DRI exports surged 542% to 507,000 tons for the period, according to ISPA statistics, while production stood at 14.6 million tons, up 22%.

Imports were down for all products. Semis imports dropped 80% to 33,000 tons and finished steel imports stood at 1.49 million tons, down 26% YOY. CRC was the only material showing growth in imports–up 9%.

Production

Iranian steelmakers produced 27.14 million tons of steel in the eight-month period to record a 12% YOY growth.

Semi-finished products made up 14.14 million tons of it, up 15%. Billet and bloom output stood at 7.52 million tons while that of slab reached 6.62 million.

Finished steel output was at 12.99 million tons, up 9% YOY.

HRC had the lion’s share of production with 5.08 million tons, followed by rebar with 4.1 million tons, CRC with 1.57 million tons, coated coil with 1.01 million tons, beam with 665,000 tons and “other steel products” with 553,000 tons.

Output growth was up and in two digits on all fronts, save for a 7% and 4% downturn in beam and rebar production.

The drop in structural steel production is justified by the construction sector’s lethargic status, which is bound to worsen even further in the next fiscal year (March 2018-19) due to slashed development allocations in the new budget bill. The bill proposes about 600 trillion rials ($14.28 billion) for development projects in the next year, showing a 110 trillion-rial ($2.61 billion) decline compared to what was allocated in the current Iranian year. Observers forecast related products’ demand and usage to dampen next year, with mills moving toward exports.

Private producers are still dwarfed by giant semi-privatized mills in terms of total output, but are starting to zoom ahead in growth.

Semi-private players produced 17 million tons of semis and finished steel, up 7% YOY, while private steelmakers’ output was up 24% to 8.85 million tons.

As part of the 20-Year Vision Plan (2005-25), the Iranian steel industry aims to become the world’s sixth largest steelmaker by reaching an output capacity of 55 million tons per year by the deadline (2025).

Usage

Iran’s total apparent steel usage was up 3.6% for the eight-month period to stand at 23.5 million tons.

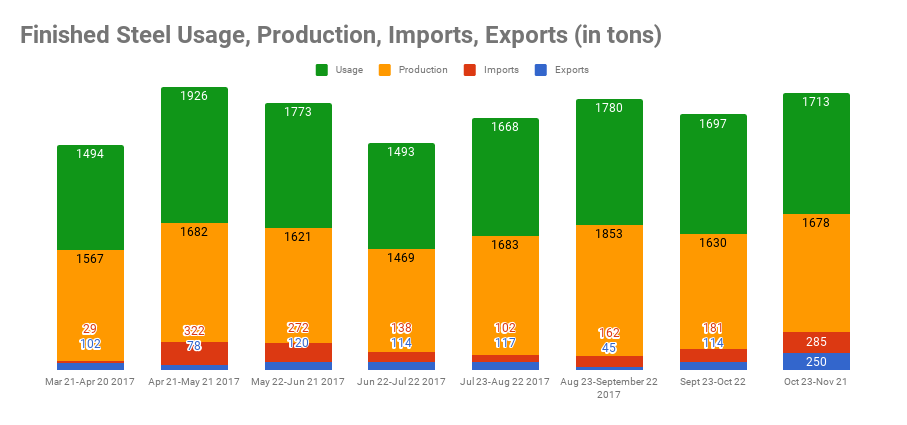

Finished steel usage stood at 13.54 million tons, showing 8% growth, with all products rising in consumption, save for rebar that posted a 12% drop to 3.79 million tons.

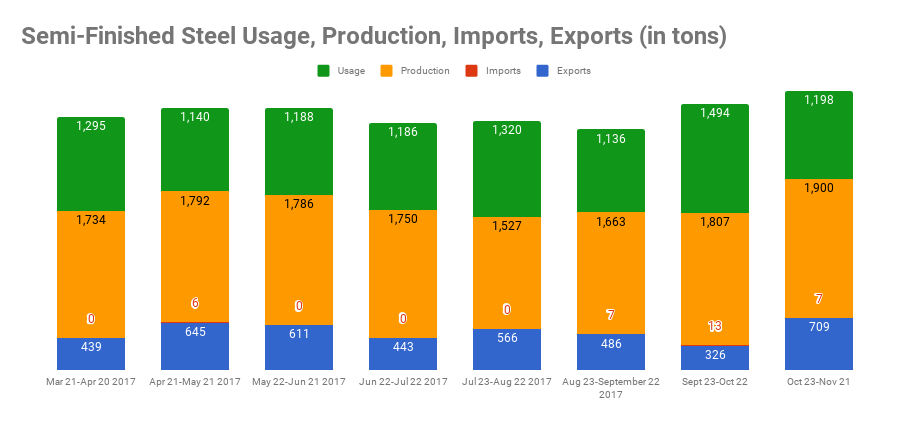

Semi-finished steel usage, on the other hand, was down 2% to 9.95 million tons. Billet and bloom usage made up 5.22 million tons of it, up 4%, and slab consumption was 4.73 million tons, down 8%.

DRI usage was also down 8% to 14.09 million tons, further supporting the material’s increased shipments abroad.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Barrick’s Reko Diq in line for $410M ADB backing

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts