Flat Steel Import Prices Rise, But Demand Stays Low

“The market is not active enough. The domestic price is less than the cost of imported goods,” a trader said.

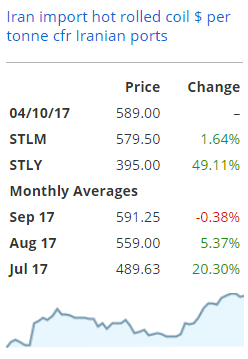

Metal Bulletin’s price assessment for imported 2-mm hot-rolled coil in Iran was $583-595 per ton CFR Iranian ports on Oct. 4, compared with $565-605 per ton a week earlier.

A 5,000-ton cargo of HRC from ArcelorMittal Temirtau was booked at $501 per ton FOB. The estimated cost of freight from Temirtau to Anzali in northern Iran is $9 per ton.

Offers of HRC from ArcelorMittal Temirtau were $586 per ton FOB, equivalent to $595 per ton CFR. One buyer was bidding $530 per ton CFR, but could get no discount.

Russia’s MMK offered HRC at €480 ($565) per ton FOB. The estimated cost of freight from Russia to Iran is around $20 per ton.

Metal Bulletin’s price assessment for imported cold-rolled coil in Iran was $625-630 per ton CFR Iranian ports on Wednesday, rising from $620-625 per ton CFR.

Offers were heard at $630 per ton CFR.

ArcelorMittal Temirtau offered the product at $590 per ton FOB, one source said, after the price assessments were published.

The weekly price assessment for Iranian hot dipped galvanized coil imports was unchanged at $705-713 per ton CFR on Wednesday.

Offers from China were heard at $660 per ton FOB after the assessments were published. The cost of freight is around $25-30 per ton from China to Iran.

The European Union has decided to set fixed duties for hot-rolled coil imported from Iran, as well as HRC from Brazil, Russia and Ukraine, after a complaint by EU manufacturers that the product used for construction and machinery was being sold at excessively low prices.

The EU will levy anti-dumping tariffs of between €17.6 and €96.5 ($20.6-112.8) per ton from Saturday, the EU’s official journal said on Friday, Reuters reported on Friday.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook