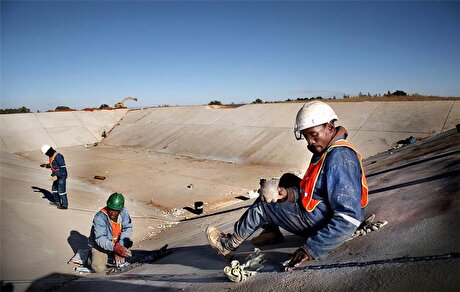

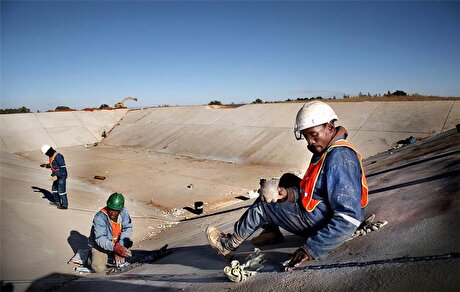

Overview of Iran’s Road Construction, Mining Machinery Market

Accordingly, providing businesses with the required machinery requires precise planning by policymakers.

In Iran, however, the market of road construction and mining machinery has usually been out of sync with the country’s economic outlook and government planning, markedly affected by a set of other factors.

For instance, the import of machinery in the fiscal years 2012-14 dropped to one-third of the volume compared to the preceding two-year period, while it suddenly doubled next year, the Persian daily Donya-e-Eqtesad reported.

Such wild fluctuations in machinery imports have much less to do with government planning than with the side-effects of temporary expansionary fiscal policies and the impact of sanctions.

Yet things seem to have rather stabilized in the past two years, streamlining the sector following the lifting of sanctions, removal of import hurdles and stability of factors affecting machinery prices.

Iran imported 1,888 road construction and mining machinery in the last fiscal year (ended March 20, 2017). The figure has grown compared to the two previous years, albeit slightly, and has yet to reach the heyday of 2001-11 when Iran was rapidly expanding its machinery and equipment access.

The limited growth in machinery imports reflects the still dominant shadow of recession in the development sector. Putting the spotlight on the types of machinery imported further underlines this trend.

Excavators accounted for 1,110 or 59% of all machinery imports last year, followed by loaders with 299 or 16%, graders with 117 or 6%, backhoe loader with 116 or 6%, rubber-track excavators with 82 or 4%, mini-loaders with 75 or 4%, rollers with 67 or 4% and bulldozers with 22 or 1%.

The significant disparity between different machinery points to the dormant infrastructure development projects, alongside consumers’ unfamiliarity with new trends in the industry and the consequent unwillingness to risk importing new machinery.

About 87% of the imported machinery last year was new, indicating the importers’ increased access to finances compared to the sanctions era and their growing appetite for brand new goods. Moreover, the government’s imposition of new limitations on the import of used equipment in the face of a robust local market has played a significant role.

A June measure approved by the Cabinet permitted the import of secondhand mining and road construction machinery by well-known international brands until the end of the current Iranian year (March 20, 2018), provided they are not older than five years.

Items listed in the new measure include roadheader excavation machinery, mechanical shovels with over 220 horsepower motors, loaders with 310 horsepower motors, bulldozers with 360 horsepower motors and dump-trucks with a loading capacity of 35 tons.

Secondhand puller trucks with over 500 horsepower motors can be imported and receive license plates under the condition that Iran National Standard Organization approves of their safety and performance.

Currently, East Asian and European brands are available in Iran’s mining machinery market, which seems to be meeting nearly all the domestic demand. Consequently, the presence of any new player in the market will mostly depend on a hike in demand.

And bringing about demand stimulation requires increased investment in infrastructure projects, clearing the government’s debts to contractors and stabilizing factors affecting machinery prices, such as the forex market and import duties.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

Adani’s new copper smelter in India applies to become LME-listed brand

OceanaGold hits new high on strong Q2 results

Trump says gold imports won’t be tariffed in reprieve for market

Cochilco maintains copper price forecast for 2025 and 2026

De Beers strikes first kimberlite field in 30 years

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%

Hindustan Zinc to invest $438 million to build reprocessing plant

South Africa mining lobby gives draft law feedback with concerns

Wooden church sets off on slow Swedish road trip to escape mining subsidence

Harmony Gold’s MAC Copper takeover gets regulatory nod

Povrly Copper Industries orders a breakdown rolling mill for high-quality copper, brass, and bronze strip production

Advanced cold-rolled strip for China’s New Energy Vehicle market

A Danieli greenfield project for competitive, quality rebar production

Antofagasta posts biggest profit margins since 2021

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%

Hindustan Zinc to invest $438 million to build reprocessing plant

South Africa mining lobby gives draft law feedback with concerns

Wooden church sets off on slow Swedish road trip to escape mining subsidence

Harmony Gold’s MAC Copper takeover gets regulatory nod

Povrly Copper Industries orders a breakdown rolling mill for high-quality copper, brass, and bronze strip production

Advanced cold-rolled strip for China’s New Energy Vehicle market

A Danieli greenfield project for competitive, quality rebar production