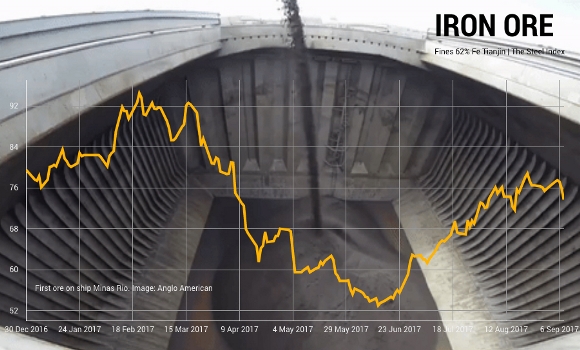

Iron ore price drops as Chinese steel begins to pile up

According to data supplied by The Steel Index the steelmaking raw material declined 3.4% to exchange hands for $70.90 per dry metric tonne, a seven week low. Data released by China's steel industry association yesterday showed mills produced record tonnage for a second straight month in August. China produces as much steel as the rest of the world combined.

The iron ore price is still trading up by more than a third from its 2017 lows struck in July as Chinese anti-pollution crackdown on its heavy industries force the country's steelmakers to chase high quality imports and avoid domestic producers which contend with Fe content in the 20%-range.

The premium paid for industry benchmark 62% iron content ore and lower grades this week hit a record high above $20 a tonne while premiums for lump ore over fines have also surged. Chinese mills increased imports by 2.8% in August compared to the month before even with inventories at the country's ports – mostly made up of medium and lower grade ore – not far off record highs of 140m tonnes.

Year-to-date imports of high-quality iron ore from Australia, Brazil and South Africa are 6.7% higher than in 2016, already a record breaking year when imports topped one billion tonnes for the first time.

pile upBut industry analysts and even some producers have been calling for a correction for months now, even for higher grades. Last month investment bank Barclays said the key signal for the end of the iron ore rally will be "the start of a new steel product inventory restocking cycle."

According to Mysteel, inventories of rebar used in construction rose by 118,000 tonnes to just over 4.7m this week, the highest since early May. The build-up in steel stocks also coincides with a slowing industrial activity within the country. China's growth in factory output dipped to 6% year-on-year down from 6.4% in July and metals-intensive infrastructure spending also slowed.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

SQM boosts lithium supply plans as prices flick higher

Nevada army depot to serve as base for first US strategic minerals stockpile

Pan American locks in $2.1B takeover of MAG Silver

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook