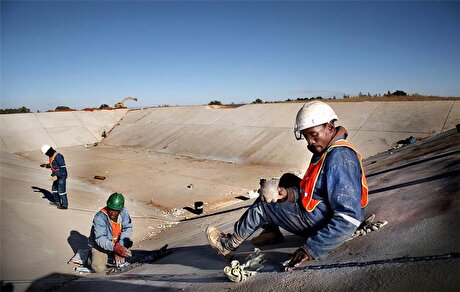

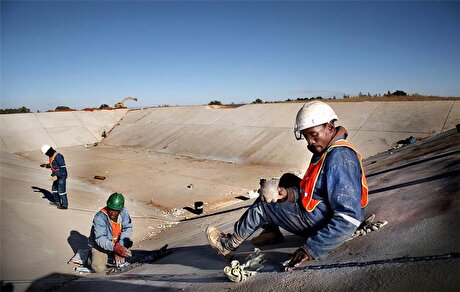

Barrick outlines growth outlook for Kibali in the DRC

According to me-metals cited from mining.com, Since pouring first gold in 2013, Kibali has replaced every ounce mined, and in-country investment has now topped $6.3 billion, the company said.

In a call with reporters, CEO Mark Bristow added that a 16 MW solar-plus-battery plant has pushed Kibali’s renewable share to 85%, allowing the site to run entirely on green power for half the year.

Underground productivity upgrades are slated to lift output from the third quarter onward, he added.

Barrick shares rose 0.49 % to $21.33 in New York on Wednesday following the update. The company’s market capitalization stands at $36.7 billion.

In a recent note, RBC reiterated an “outperform” rating and lifted Barrick price target to $26.00, implying a further 22% upside.

Kibali plays a crucial role in the local economy of the DRC’s North East region. Over the past decade, it has helped develop a thriving regional economy, supported by partnerships with local businesses and communities, Barrick said, adding that it has invested almost $3 billion, including deals with local contractors and suppliers.

The gold mine is owned 45% by Barrick, 45% by AngloGold Ashanti and 10% by Société Miniére de KiloMoto (SOKIMO).

source: mining.com

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

Adani’s new copper smelter in India applies to become LME-listed brand

OceanaGold hits new high on strong Q2 results

Trump says gold imports won’t be tariffed in reprieve for market

Cochilco maintains copper price forecast for 2025 and 2026

De Beers strikes first kimberlite field in 30 years

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%

Hindustan Zinc to invest $438 million to build reprocessing plant

South Africa mining lobby gives draft law feedback with concerns

Wooden church sets off on slow Swedish road trip to escape mining subsidence

Harmony Gold’s MAC Copper takeover gets regulatory nod

Povrly Copper Industries orders a breakdown rolling mill for high-quality copper, brass, and bronze strip production

Advanced cold-rolled strip for China’s New Energy Vehicle market

A Danieli greenfield project for competitive, quality rebar production

Antofagasta posts biggest profit margins since 2021

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%

Hindustan Zinc to invest $438 million to build reprocessing plant

South Africa mining lobby gives draft law feedback with concerns

Wooden church sets off on slow Swedish road trip to escape mining subsidence

Harmony Gold’s MAC Copper takeover gets regulatory nod

Povrly Copper Industries orders a breakdown rolling mill for high-quality copper, brass, and bronze strip production

Advanced cold-rolled strip for China’s New Energy Vehicle market

A Danieli greenfield project for competitive, quality rebar production