LME looks to curb big bets as energy trader billions rock metals

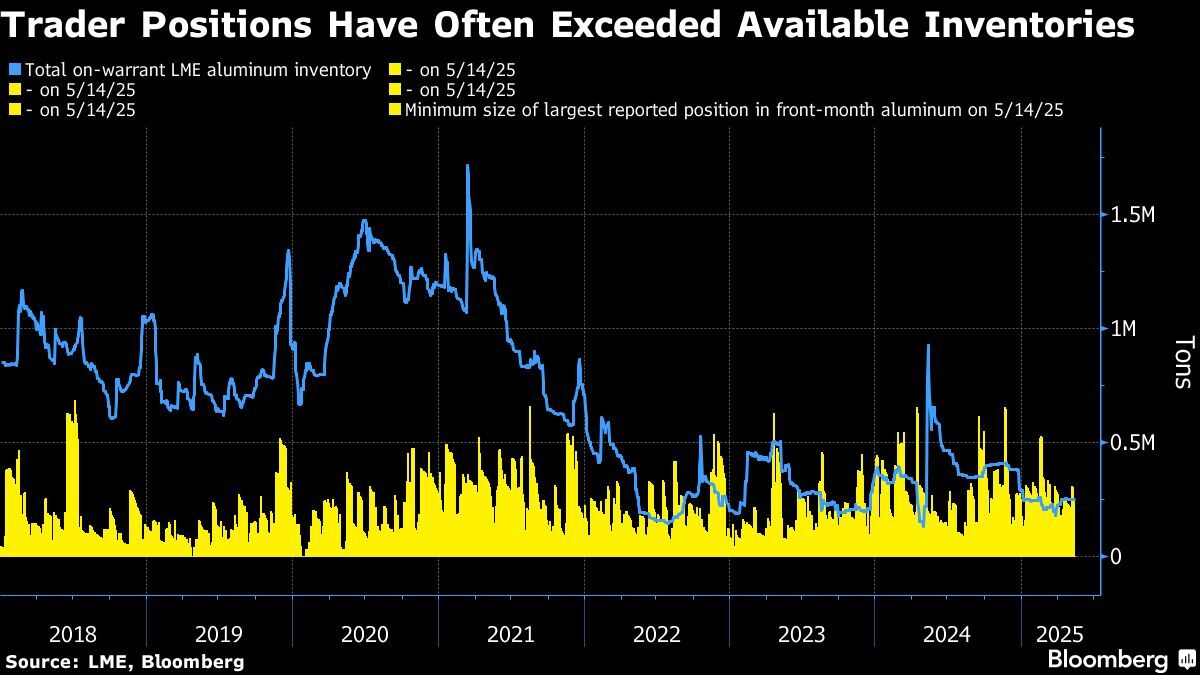

According to me-metals cited from mining.com, The LME, which hosts global benchmark prices for key industrial metals such as aluminum, copper and nickel, has been discussing the appropriate level for position limits in informal conversations with market participants, according to people familiar with the matter. It has suggested it could seek to prevent traders from taking positions in the nearby month’s contracts larger than the total inventory, the people said, asking not to be named as the talks are private.

The conversations come as responsibility for setting position limits in UK commodity markets is due to be transfered from the Financial Conduct Authority to individual exchanges from July 2026, according to a policy statement from the regulator earlier this year. The LME is likely to make a formal proposal on position limits to the market at some point before then, the people said.

At the same time, the LME has been rocked in recent months by the arrival of some of the world’s largest energy traders. They have made an aggressive push into metals markets after making tens of billions of dollars in profits in oil and gas trading in the wake of Russia’s full-scale invasion of Ukraine.

Vitol Group, Gunvor Group and Mercuria Energy Group Ltd. have all in recent months had positions on the LME that exceeded the total available inventory. Most recently, Mercuria built up a huge position in aluminum in a bet that any easing of sanctions against Moscow would tighten the market, Bloomberg reported this week.

While the LME has been in contact with each of the trading houses about their positions, there’s no rule to prevent traders amassing large bets in the market — indeed, it has been a feature of trading on the exchange for almost all of its 148-year history.

The FCA imposed position limits on UK commodity markets for the first time in 2018, but it set them at such high levels as to be largely irrelevant.

The position limit for aluminum in the nearby month’s contracts, for example, is equivalent to 1.19 million tons — more than four times currently available inventories. In nickel, the overall position limit of nearly 500,000 tons is far larger than the vast position built up by Chinese nickel company Tsingshan Holding Group Co. that triggered a short squeeze that almost destroyed the exchange in 2022.

The LME hasn’t yet decided where to set position limits, the people said, and any overly restrictive policy may have unintended consequences. A crucial question will be how to define the total inventory, the people said: the exchange currently publishes data on “on-warrant” stocks, “canceled” stocks that are in the LME system but have been requested for delivery, and “off-warrant” stocks that are outside the system but could be delivered.

An LME spokesperson said on Friday that the exchange is working on its implementation plan in response to the FCA’s final rules and guidance on reforming the commodity derivatives regulatory framework. “We will keep the market informed as we work towards the roll-out of the new framework on 6 July 2026.”

source: mining.com

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Barrick’s Reko Diq in line for $410M ADB backing

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts