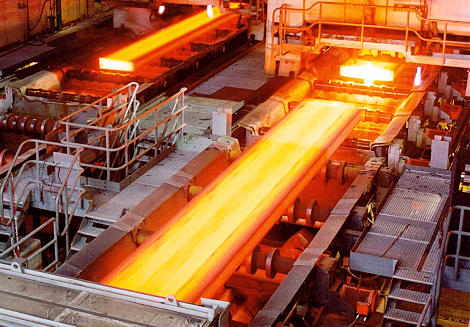

Iranian Steel Mills to Boost Billet Supply to Domestic Market

The Iranian government has asked domestic steel mills to allocate more billets to the domestic market where demand has increased significantly, informed sources in Tehran said on Thursday.

The sources confirmed a report on the Iranian Steel Producers Association’s website on Wednesday that the request had been made, but said there was no immediate talk of banning billet exports, S&P Global Platts reported.

Officials from major steel producers, the Iran Mercantile Exchange and the producers’ association had attended a meeting organized by the Minister of Industries, Mining and Trade Mohammad Reza Nematzadeh on Tuesday to discuss the impact of billet price increases in the domestic market, the sources said.

“The country’s steel industry has been instructed to allocate at least 50% of output to the domestic market through IME, and with a base price of an average of three international market indices,” ISPA Vice President Hamidreza Taherizadeh was quoted as saying by Chilanonline, the ISPA’s website.

“Exports will continue, although domestic demand will be a priority for billet producers,” he added.

Taherizadeh said re-rollers were waiting for the billet to become available and were also ready to import if the import duty on billet was removed and domestic producers were unable to cover their requirements.

The import duty on billet is currently 15% and a 9% VAT is also payable.

The market reacted very quickly to the latest news. The Iran Mercantile Exchange said 5,000 tons of Khouzestan Steel Company’s billet were traded on the exchange on Wednesday at 19.8 million rials ($600/ton), down 3.4% from Monday.

It is not yet clear whether the billet import duty will be removed. Such a measure would take three to four weeks to be put into place, one market player in Tehran suggested.

He said it was more likely the current policy of seeking to have more domestic steel allocated to downstream industries would continue, with production also expected to be increased over the next few months.

Following the Tuesday meeting, steelmakers gathered at ISPA headquarters in downtown Tehran to determine each producer’s share in supplying the domestic market.

Producers at the meeting included Mobarakeh, Khouzestan, Esfahan, Arfa, Khazar, South Kaveh, Kavir and Saba Zagros steel companies, Fooladnews reported.

Seeking a compromise between billet producers and users, Khouzestan Steel Company pledged to increase its monthly IME supply by 10,000 tons to 60,000, and to 80,000 tons in the long run. KSC is Iran’s largest billet producer and was the country’s most prolific exporter last year.

Arfa announced it would sell 80% of its current fiscal year (March 2017-18) output in the local market. It produced 723,000 tons of semi-finished steel the year before, according to data released on Tehran Stock Exchange.

South Kaveh Steel Company is planning to supply at least 15,000-20,000 tons of billets to the domestic market each month, while gradually increasing the figure based on local demand and export prospects. SKSCO manufactured 624,358 tons of billets last year and exported 298,365 tons, accounting for 6.6% and 13.8% of the country’s billet output and shipments, respectively.

Khorasan Steel Company says it is halting exports until the local market can be rebalanced and aims to supply at least 20,000 tons of billets on IME every month.

Without presenting numbers or exact plans, other producers emphasized that they would continue to “meet local demand while moving toward expanding steel exports”.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook