Iran’s Billet Suppliers Cement Foothold in MENA

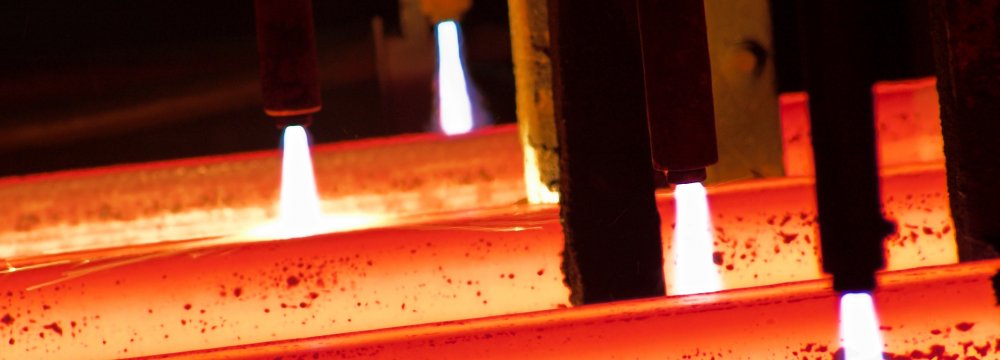

Khouzestan Steel Company and Esfahan Steel Company dominate Iran’s billet exports.

Khouzestan Steel Company and Esfahan Steel Company dominate Iran’s billet exports.

Expectations announced last year by Iranian billet sellers to improve their presence in export markets have been fulfilled.

Favorable market conditions along with lower competition with suppliers in China and Commonwealth of Independent States significantly increased billet exports from Iran during the previous Iranian year (ended March 20, 2017).

Iran thus established a foothold not only in traditional sales destination–that is Middle East and North Africa region–but also managed to penetrate new markets, Southeast Asia in particular.

Over the 11 months of the previous Iranian year (March 21, 2016–February 18, 2017), Iran exported some 1.9 million tons of square billets and blooms, 29% up year-on-year, Iranian Steel Producers Association reported.

Khouzestan Steel Company, Iran’s largest semis maker, and Esfahan Steel Company dominate Iran’s billet exports, though last year, Khorasan Steel, Kish South Kaveh Steel and others joined the list of exporters. This expansion trend continues, but the share of newcomers is low so far.

About 70% of Iran’s billet exports went to the MENA region, according to Metal Expert.

Despite a loss of such a large buyer as Saudi Arabia due to political issues, Iran managed to improve positions in the Persian Gulf region, UAE and Oman in particular.

Over the previous year, Iran raised billet shipments to this region by 312,000 tons. Exporters from Iran used an opportunity of the growth of the billet spot market, which was driven by Chinese policy of low pricing in H1 2016.

Besides, lower competition with CIS producers, which focused on margins instead of volume in 2016, also contributed to the growth of Iranian exports.

In addition, Iran established closer cooperation with Egypt and Turkey and provided semis to Jordan and Morocco.

“Iran is offering a very competitive price compared to other suppliers, which makes their positions stronger in the region,” a market insider told Metal Expert.

Expansion Plans

This year KSC, ESCO and other producers want to ramp up shipments to MENA.

KSC has set an export target for the current Iranian year (started March 21, 2017) at 2 million tons of semis, of which 1.2-1.3 million tons are billet, and the rest is slabs. The producer plans to achieve this figure, thanks to shipments to traditional markets and the new ones.

For example, KSC is in negotiations with Libya as it sees potential in this country.

“The Middle East is a traditional market for us, so all the promising markets will be covered in the [Iranian] new year,” a company representative told Metal Expert.

ESCO is following the same strategy.

“Although we are more interested in sales of finished products, we are exporting around 60% of our billet to the Persian Gulf region,” a source from ESCO said.

SKS, which sold just 55,000 tons of billet to the Persian Gulf region last year (30% of total exports) intends to increase shipments.

Shifting Market Dynamics

The MENA region, however, may have to compete with Southeast Asia and other markets for volumes of Iranian semis. The price increase for Chinese steel billet, started in Q4 2016 amid the decision to focus on domestic sales, is now urging buyers to look for other suppliers.

As a result, while China is losing its market share in its traditional outlet, Southeast Asia, other suppliers, including Iran, are gaining presence in the region. Iranian sellers have already penetrated Thailand, Indonesia, and Malaysia.

“When prices for billet start to grow in Southeast Asia, it makes sense to sell volumes to that destination,” a source at KSC noted.

“For sure, Asia is a good target for us and considering the increasing amount of inquiries, I think the Philippines and Thailand will be our future customers although payment procedures have to be agreed,” an ESCO representative said.

SKS aims to enhance shipments to Vietnam, Taiwan, Thailand and Indonesia.

Nevertheless, there are some factors, which could shift Iran’s focus in billet export. First of all, Iran and countries in the Persian Gulf region start to seek ways of easing political tension. Thaw in relations may result in closer attention to regional steel buyers.

In addition, the potential of Egypt’s and Turkey’s market in terms of semis supply has not been fully tapped by Iranian producers.

Sooner or later China will return to export segment. How this will change Iran’s positions in Asia, only time will tell.

Nevertheless, it is obvious that in terms of production cost, Iran can be a worthy competitor to China, which traditionally dominates this market.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook