CBI Sets New Foreign Currency Rules

According to the directive announced on the official website of the bank, keeping foreign exchange up to €10,000 (or its equivalent in other currencies) faces no legal barriers.

Retaining an amount of foreign currency higher than the set limit is allowed only if the applicant obtains one of the following documents:

- A bank's receipt or any other document indicating that the amount has been reimbursed by a bank.

- An authorized receipt from an exchange house registered in CBI's SANA system.

- A printed receipt containing the tracking code that indicates the currency was declared when entering the country.

The directive noted that if someone is in possession of a larger amount of hard currency than the set limit and does not have one of the aforementioned documents, they need to open a foreign currency account in one of the banks or sell the currency to a bank or licensed exchange within three months.

Banks and bureaux de change's receipts that show the currency has been paid by them is only valid for six months and owners need to open a currency account or sell the sum within the allowed period.

The directive emphasized that any conversion, purchase and sale of currency outside the banking system or authorized bureaux de change is prohibited.

Last year, Iran authorized banks to undertake foreign exchange trading at a free-market rate, as authorities plan to unify exchange rates.

Iran operates two exchange rates: a free market rate, which was at 37,062 rials to the US dollar on Monday, and an official rate used for state transactions, set by the central bank at 32,439 rials.

In recent months, the central bank has raised the official rate gradually to shrink the gap between the two. It has said it wants to unify the exchange rate, to make the economy more efficient and create a level field for private firms competing with state institutions with access to cheaper foreign exchange.

In November, the CBI also issued a directive requiring travelers and truckers in transit entering the country to declare currency valued over $10,000 to the Ministry of Economy’s Financial Intelligence Unit, in line with international anti-money laundering statutes.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Chile’s 2025 vote puts mining sector’s future on the line

Gold price could hit $4,000 by year-end, says Fidelity

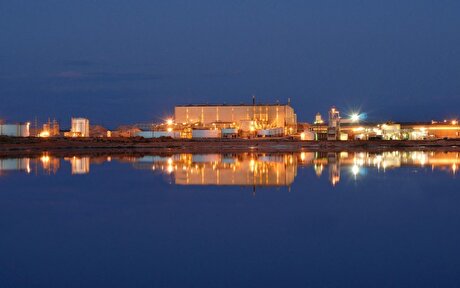

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

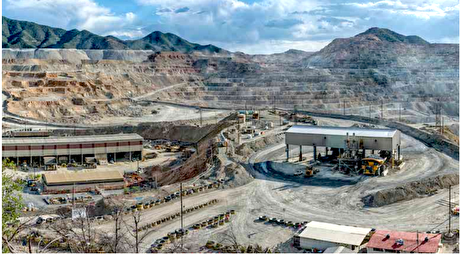

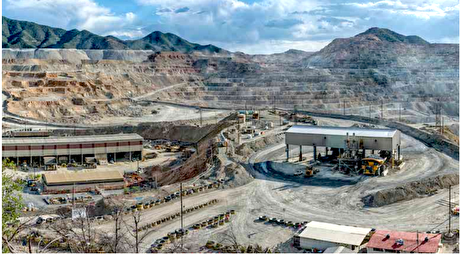

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming