Pakistan: Cautious Buying Pulls Down Imported Scrap Prices

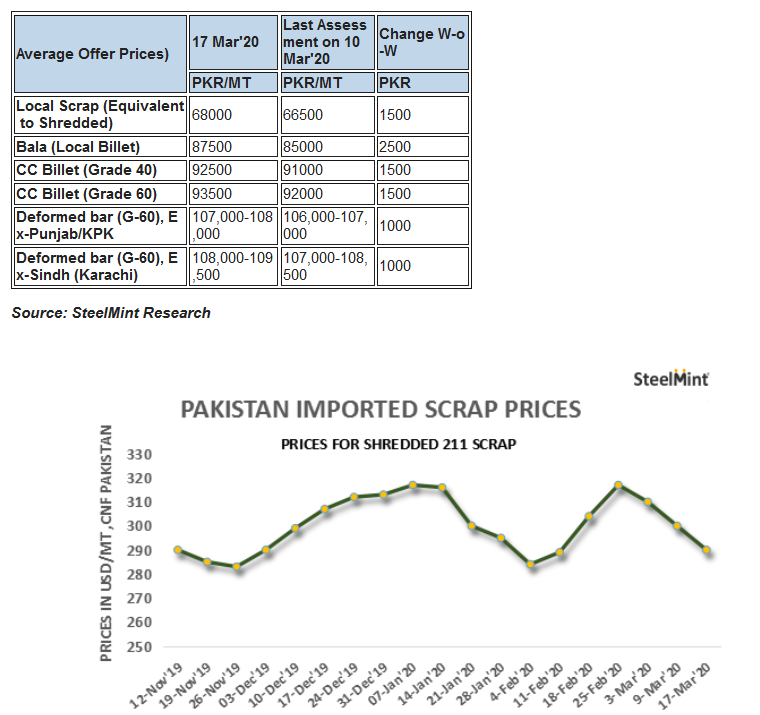

SteelMint’s assessment for Shredded 211 from UK/Europe stands at USD 290/MT CFR, down sharply by USD 10-11/MT against last week. Although offers for March loading are USD 300/MT and above due to premium for prompt shipment, however, for April loading, the offers stand at USD 289-290/MT CFR from UK. A couple of bookings were reported at USD 290-291 in the recent few days. Some offers from USA were reported slightly lower by USD 2-3/MT.

Buyers are currently targeting USD 285/MT levels for Shredded, and the workable price may drop to these levels. However, due to the continuation of the container shortage situation, market anticipates that the suppliers may not be able to deliver the shipments on time.

HMS scrap from Dubai is being offered at around 280-290/MT CFR, depending on quality and may decline further in the coming days.

Pakistani Rupee depreciated last week on slump in economy due the covid-19 outbreak and its impact on Chinese investments in Pakistan. From 154 levels over a week ago, the PKR slumped to 160 levels against USD by the end of last week and currently hovering at 158-159 levels.

Domestic Steel Prices Appreciate – Due to the Ramzan month starting from the last week of April, infrastructural projects are under pressure to get completed before that, resulting in some improvement in steel demand and consequently pushing the domestic prices up, which had remained more-or-less flat for several weeks now. Depreciation in currency and stock market situation also contributed to the rise in steel prices.

Local scrap and CC Billet prices also moved up by PKR 1500/MT w-o-w, while bala billet offers surged by PKR 2500/MT. In the northern region, rebar’s average offer prices were reported at around PKR 107,000-108,000/MT, ex-works (USD 671-677), up PKR 1000/MT w-o-w, while southern (Karachi region) steel mills are offering at PKR 109,000 ex works.

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

NextSource soars on Mitsubishi Chemical offtake deal

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Australia weighs price floor for critical minerals, boosting rare earth miners

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF