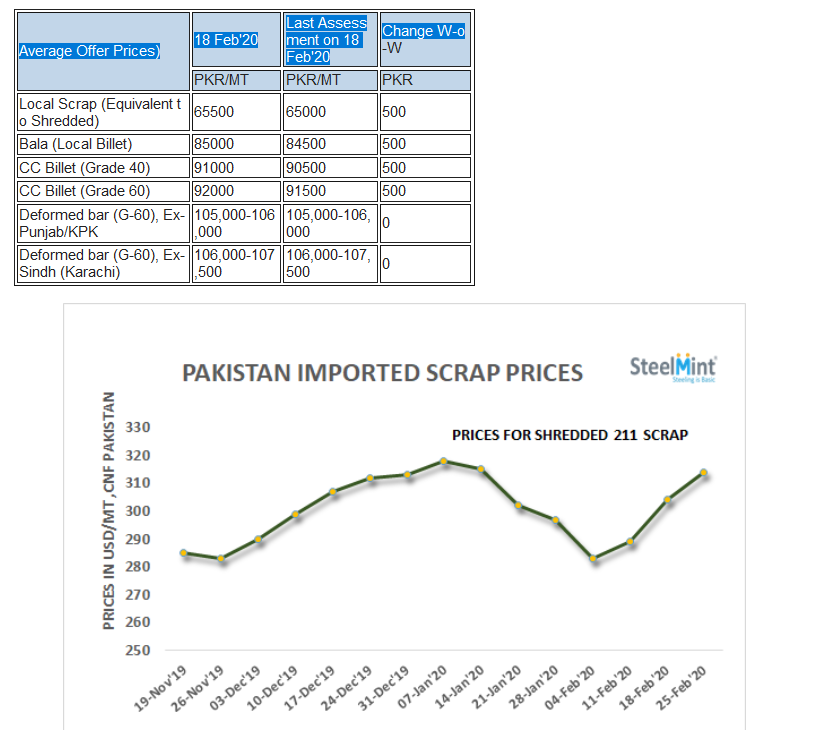

Pakistan: Imported Scrap Prices Continue Uptrend on Active Buying

This week, Mughal Steel, a top Steelmaker from Punjab region, booked a 30,000 MT of bulk cargo, comprising of 26,000 MT of Shredded scrap at USD 306/MT, CFR and 4,000 MT of P&S at USD 311/MT CFR Qasim, from a USA recycling yard, for March shipment.

SteelMint’s assessment for containerized Shredded 211 scrap from UK/Europe currently stands in the range of USD 310-318/MT CFR, rising by USD 8-10/MT over the last one week, while witnessing an incremental increase of USD USD 4/MT against the closing of last week. Presently offers from UK/European origins have climbed up to USD 315-318/MT, CFR range.

Container bookings for shredded were very active all through the week, with many bookings at USD 311-312/MT concluding till yesterday from Europe as well as North American origins, while after further hike in offers today, workable price too will drive up, on high material requirement by mills currently.

“Sold around 5,000-6,000 MT of shredded at closing of last week at around USD 310/MT, and now prices even higher; traders are pushing market upwards and buyers resisting” shared a reliable market trade source.

Many sources also shared that the freight transit times for container bookings have increased, due to the ongoing container shortage from European origins, which has also resulted in a rise in prices.

HMS offers from UAE have recently witnessed increase due to tightness in supply, and HMS 1 super (no ci gi) are being offered at USD 305/MT CFR, while good bookings from India recently has kept the prices supported. HMS from other origins were not witnessed in significant

Domestic steel market remains subdued – On account of consistent increase in imported scrap prices, local billet and scrap prices moved up marginally, however no improvement in finished steel sales has kept steel bar prices unchanged for over 6 weeks now. Steel demand is expected to remain weak, with all major infrastructural projects involving Chinese officials stalled since novel corona-virus outbreak, in addition to the slowdown in overall infrastructural sector.

In the northern region, rebar’s average offer prices were reported at around PKR 105,000-106,000/MT, ex-works (USD 679-686), while southern (Karachi region) steel mills are offering at PKR 107,000.

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

NextSource soars on Mitsubishi Chemical offtake deal

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Australia weighs price floor for critical minerals, boosting rare earth miners

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF