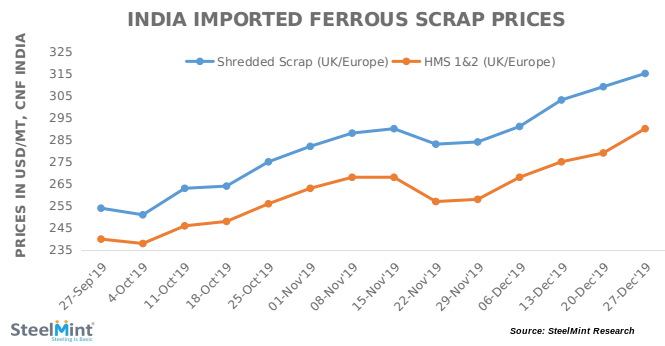

Imported HMS Scrap Trades to India Improve Despite Hike in Offers

SteelMint assessment for containerized Shredded from the USA and UK to India rose sharply to around USD 315/MT, CFR Nhava Sheva, up by around USD 5-6/MT against last weeks report, while the offers have now risen by USD 13/MT over the last 2 weeks. Apart from a few small quantity bookings, no major trades for shredded were reported this week.

No shredded offers from North European yards were received due to holidays, while few other European yards were reportedly getting good business at higher price levels in domestic European markets, and hence may stay away from offering large quantities to South Asian markets in Jan’20.

HMS scrap observed decent trades this week from most of the origins. South African origin HMS was sold at USD 300/MT CFR Nhava Sheva with few bookings to Mundra port also being concluded at similar levels, however fresh offers from South African suppliers have now reached USD 305-308/MT CFR.

HMS 1 super (no ci gi) was booked at USD 300/MT CFR Nhava Sheva with average trades, while new offers currently in the range of USD 300-305/MT CFR. Additionally, HMS saria/PnS was also booked at USD 313/MT CFR this week. HMS 1&2 of good quality from South American origins was sold at USD 295/MT CFR while new offers are reaching close to USD 300/MT.

Few sales for West African origin HMS 1&2 were witnessed at around USD 290/MT yesterday. Goa market also observed purchase of mixed grade - HMS & Cast, sold at USD 300/MT CFR Goa.

The recent rise in imported offers have kept the domestic scrap prices supported, which have shown rallied up over the last week, with HMS 1&2 (80:20) prices in Mumbai rising by INR 700-800/MT USD (10-11) and currently standing at INR 22500/MT (USD 315)ex Mumbai.

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Copper price collapses by 20% as US excludes refined metal from tariffs

Gold price rebounds nearly 2% on US payrolls data

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project