Indian sponge iron makers eye SA coal alternatives

"The industry is exploring…alternatives in [the] form of Australian, Mozambique and even Russian coal", Rahul Mittal, president of the Sponge Iron Manufacturers Association told Argus.

South African coal prices have risen since September, hurting many firms' margins and contributing to the closure of some sponge iron units and production cuts.

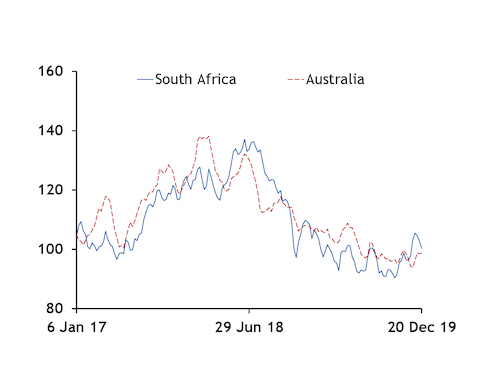

NAR 6,000 kcal/kg fob Richards Bay spot prices averaged $84.15/t over the week ending 20 December, rising by 43.5pc, or $25.53/t, since the final week of September, Argus assessments show.

Sponge iron, also known as direct-reduced iron (DRI), is made by directly reducing iron ore through the use of a reducing gas or thermal coal in an electric arc furnace. Most of India's gas-based sponge iron production is consumed captively as an input for processed steel products, while merchant sales of sponge iron come mostly from coal-based units. The sponge iron industry imports 20mn-25mn t/yr of thermal coal, market participants said.

India has a total DRI production capacity of 46mn t/yr, with coal-based units accounting for a share of more than 70pc. At least half of the coal-based capacity relies on seaborne supplies, especially from South Africa.

Sponge iron firms that consume coal largely prefer the NAR 5,500 kcal/kg South African variety because of its fixed carbon content of about 52pc, market participants said. But over the past six-weeks, India-delivered prices, including taxes and rail transport averaging a distance of 700km, of this grade have been at a premium to the NAR 5,500 kcal/kg Australian coal for the first time since January. Recently, the South African coal's premium to Australian coal peaked at $9.30/t over the week ending 29 November. But the South African coal's premium narrowed to about $1.60/t last week, with a delivered price, including taxes and rail transport, of about $100.30/t, Argus estimates.

Despite the price edge, the equivalent calorific-value Australian product has a lower fixed carbon content of 44-46pc.

Indian sponge iron producers are major buyers of South African coal, and a potential switch to alternative origins could limit South African exports — potentially weighing on spot prices in return.

Despite rising NAR 6,000 kcal/kg South African spot prices, Indian imports of thermal coal of this origin climbed to a seven-month highof 4.04mn t in November, data from shipbroker Interocean show. Seaborne deliveries in India have increased amid low output from state-controlled mining firm Coal India, which supplies more than 80pc of India's coal demand.

Meanwhile, sponge iron prices have gradually improved after hitting a low of about 15,500 rupees/t (about $217/t) in August to Rs18,200/t now, Mittal said. Prices rose with increased export demand for billets made from sponge iron and local shortages.

Some price support has also recently come from a seasonal drop in ferrous scrap imports, a key substitute for sponge iron in the local steel industry, he said.

The sponge iron sector has been hit hard this year by a slowdown in India's construction industry and prolonged monsoon rains. Economic activity hit its weakest quarterly economic expansion in more than six years, with July-September growth registering at just 4.5pc, down from 5pc in April-June.

By Saurabh Chaturvedi

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Copper price collapses by 20% as US excludes refined metal from tariffs

Gold price rebounds nearly 2% on US payrolls data

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project