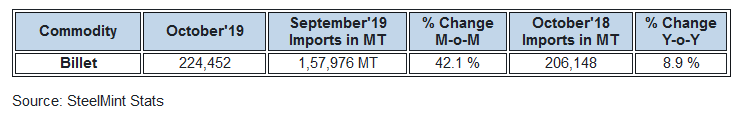

Philippines Billet Imports Surge 42% M-o-M in Oct’19

During Sep’19, dull domestic demand and piling inventories level in India has upturned the country’s interest towards SE Asia. This has resulted in disparity between bids offers, as; Indian marketers started offering billets at competitive prices with Russia and Iran. Meanwhile, buyers from SE Asia/Philippines were also trying to pull down the offers and preferred to be in wait and watch position. This has created the price war between and India, Russian and Iran in the region and has resulted in limited trades during Sep’19.

SteelMint’s assessment for SE Asia billet import was recorded at USD 400-405/MT, CFR in end of Oct’19

When in Oct’19, the Chinese government announced production curbs, the trade space for these countries; India, Russia and Iran, got widen up and Philippines along with SE Asia went trade active. The event was supported by Turkey’s imported scrap prices, which have started rebounding since Oct’19 and are still maintaining the pace. Since then, Turkey’s imported scrap prices have managed to keep the billet market sentiments robust. Below table figures say it all.

Codelco seeks restart at Chilean copper mine after collapse

Hudbay snags $600M investment for Arizona copper project

Uzbek gold miner said to eye $20 billion value in dual listing

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling