4 charts that say this time the copper price surge could last

In afternoon trading in New York, copper for delivery in March continued to climb, hitting $2.7535 a pound ($6,070 a tonne), up 3.4% on the day and the highest since July.

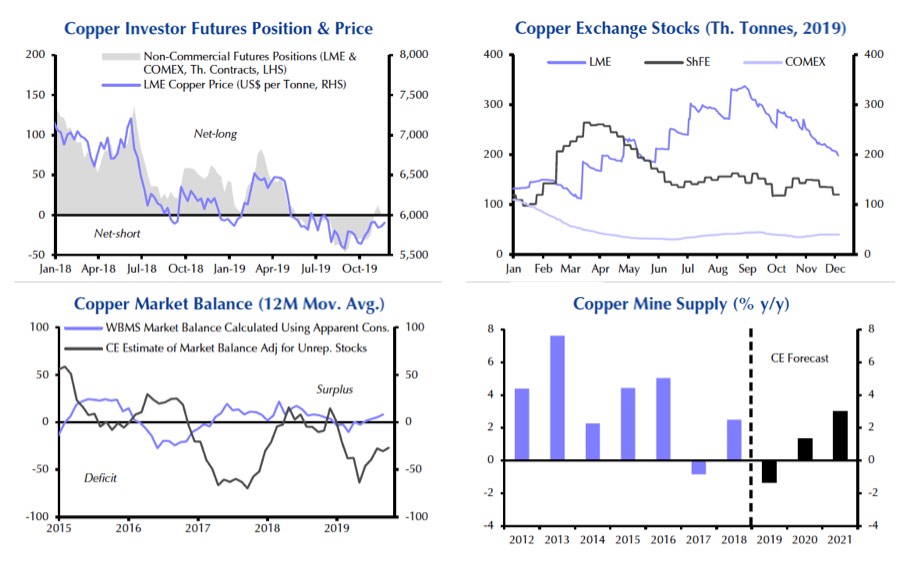

Copper was also buoyed by an improvement in sentiment among large-scale investors in copper futures like hedge funds and a drawdown of stocks, a note from Capital Economics on Thursday points out.

The combined position on the LME and COMEX futures markets switched to a net long recently after hitting a record number of net shorts (bets that copper could be bought back at lower price in future) at the end of the third quarter.

Caroline Bain, Chief Commodities Economist at the London-HQed firm, says the prospects for copper prices in 2020 are positive:

For one, copper supply is probably less ample than the “apparent consumption” data indicate.

And while mine supply growth is likely to recover in 2020 and 2021, it should remain weak by past standards.

Barrick’s Reko Diq in line for $410M ADB backing

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Pan American locks in $2.1B takeover of MAG Silver

US adds copper, potash, silicon in critical minerals list shake-up

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

Gold price gains 1% as Powell gives dovish signal

Gold boom drives rising costs for Aussie producers

Giustra-backed mining firm teams up with informal miners in Colombia

US seeks to stockpile cobalt for first time in decades

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook