Vale returns looking for low-cost debt after Brumadinho tragedy

In January, following the collapse of a tailings dam at an iron ore mine in the Brumadinho region, Vale pulled back on original plans to refinance debt. Ten months and a public relations debacle later, a surfeit of lenders, including relationship banks with established ties to the miner and new lenders looking to forge a bond with one of Latin America’s most frequent borrowers, are expected to flock to the transaction.

A dearth of opportunities to lend to high-quality Latin American corporations has left banks with little option but to aggressively compete for business, giving borrowers cheap access to capital, and clout to dictate lending terms that allow for cost savings and flexibility.

A surfeit of lenders, including relationship banks with established ties to the miner and new lenders looking to forge a bond with one of Latin America’s most frequent borrowers, are expected to flock to the transaction

“There are just too many banks in the region,” one senior banker said. “The competition in Latin America, it’s like cowboys.”

Vale, rated Ba1/BBB-, has mandated Citigroup, Credit Agricole, MUFG and SMBC to lead a new five-year revolving credit facility, according to three sources with knowledge of the financing. The leads have offered the loan at just 90bp over Libor and will launch it to additional banks on Thursday during a bank meeting in New York.

Spokespersons for Vale were not immediately available for comment.

In the first quarter of 2019, Brazilian corporate borrowers, including paper producer Klabin, oil and gas giant Petróleo Brasileiro (Petrobras) and energy company Raízen, among others, brought to the syndicated loan market a collective $4.85bn in loans. Banks’ appetite for some of Brazil’s strongest credits enabled the companies to price their loans at razor-thin levels between 105bp-150bp over Libor.

With Vale’s new deal, syndicated loan issuance in Latin America will tick over $50bn, a number not reached since 2007, according to data from Refinitiv LPC.

A few jumbo transactions from blue chip borrowers have helped bloat that volume. Mexican telecommunications firm América Movil signed a $2.5bn loan in August, Mexican oil company Petróleos Mexicanos raised a mammoth $8bn in July and French energy company Engie obtained roughly $6bn from banks to back its purchase of the TAG natural gas pipeline from Petrobras in April.

“We’ve seen a number of big, liquid banks with appetite in the region. Unlike the US, most banks are only focused on certain names, particularly the companies you can cross-sell. This makes pricing more competitive,” a second banker said.

Moving forward

Vale has long been expected to return to the syndicated loan market this year. The company has a $3bn five-year revolving credit line it signed in May 2015 up for renewal next year and a $2bn facility maturing in 2022.

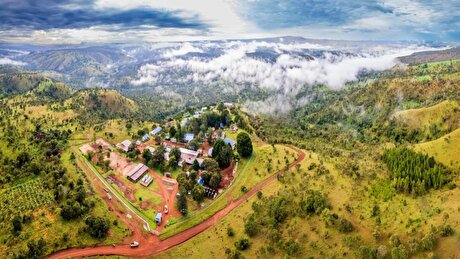

In January, the miner sent out a request for proposals to its relationship banks regarding a new five-year credit line. Vale held off on launching a deal after the tailings dam collapse at its Corrego do Feijão iron ore mine in Brumadinho on January 25 left at least 248 people dead.

The collapse brought into question Vale’s safety record and due diligence practices. The company was hit with various reparation costs and financial obligations related to the incident. It was also less than four years after a similar collapse at the Samarco mine in Brazil, which left 19 people dead in 2015. Vale and Anglo-Australian miner BHP own Samarco through a joint venture.

“They had to get their own house in order before the banks could be seen funding them,” a third syndicated loans banker said.

In September, Fitch Ratings removed Vale’s BBB- rating from negative watch due to improved visibility over potential costs from the tailings dam collapse. This put into motion plans for the company to return to the bank market, sources said.

“In Brazil, pricing has gotten tighter, so it’s ideal timing for Vale to return and refinance,” the first banker said.

Vale is on course to end 2019 with roughly $18 billion in adjusted Ebitda, excluding provisions related to the tailings dam, Fitch said.

NexMetals receives EXIM letter for potential $150M loan

Lifezone Metals buys BHP’s stake in Kabanga, estimates $1.6B project value

China quietly issues 2025 rare earth quotas

BHP delays Jansen potash mine, blows budget by 30%

BHP, Lundin JV extends useful life of Argentina copper mine

Gold price eases after Trump downplays clash with Fed chair Powell

Northern Dynasty extends losses as it seeks court resolution on Pebble project veto

KoBold signs Congo deal to boost US mineral supply

Spring Valley gold project in Nevada gets federal approval

Copper price pulls back sharply ahead of US tariff deadline

Teck approves $2.4B expansion of Highland Valley Copper

Titan Mining targets Q4 2025 to become only integrated US graphite producer

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Saskatchewan Research Council adds full-scale laser sorter to mining industry services

Copper price hits new record as tariff deadline looms

Glencore workers brace for layoffs on looming Mount Isa shutdown

Resolute publishes initial resource for satellite deposit near Senegal mine

Brazil producers look to halt pig iron output as US tariff threat crimps demand

US targets mine waste to boost local critical minerals supply

Titan Mining targets Q4 2025 to become only integrated US graphite producer

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Saskatchewan Research Council adds full-scale laser sorter to mining industry services

Copper price hits new record as tariff deadline looms

Glencore workers brace for layoffs on looming Mount Isa shutdown

Resolute publishes initial resource for satellite deposit near Senegal mine

Brazil producers look to halt pig iron output as US tariff threat crimps demand

US targets mine waste to boost local critical minerals supply

Gold price eases after Trump downplays clash with Fed chair Powell