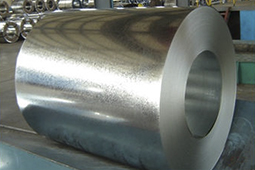

EU investigates China steel HDG duty circumvention

The commission said the duties, imposed in February last year, have been circumvented by the addition of thin oil coatings, or increasing content of carbon or other elements, or amending the coating. The existing duty ranges from 17.2pc to 27.9pc, depending on the mill.

Chinese imports of HDG registered 1.18mn t over the first nine months of this year, up by 16pc from 1mn t over the same period of 2018 — this is despite the imposition of the definitive steel safeguard, which has supposedly reduced the availability of Chinese material subject to anti-dumping measures, categorised under the 4A code.

Availability of 4B material, destined for the automotive sector and not subject to duties, has been protected by the commission. But China obliterated its 527,164t quota for July 2019-June 2020 on the day it opened. Import statistics show 750,676t of Chinese HDG cleared customs in July, up by 583pc from the same period last year, as traders looked to pass customs before the quota level was breached.

The commission's review of its safeguard, implemented on 1 October, actually saw some Taric codes listed under 4B moved into the 4A portion of the safeguard to ensure availability for automakers. But this opened a theoretical loophole whereby Chinese material that was previously dumped could clear customs under the other countries portion of the 4A safeguard. Nevertheless, over 500,000t of the October-December other countries quota remains available, suggesting that nobody has exploited this to any real degree.

By Colin Richardson

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Copper price collapses by 20% as US excludes refined metal from tariffs

Gold price rebounds nearly 2% on US payrolls data

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

Goldman told clients to go long copper a day before price plunge

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project